Appraisal gaps persist between white and both Black and Hispanic/Latino majority neighborhoods, but updated data indicate a decreased gap following actions by stakeholders and federal, state, and local agencies, including the release of the PAVE Action Plan. More analysis is needed to determine whether this is a causal relationship.

Introduction

The federal Interagency Task Force on Property Appraisal and Valuation Equity (PAVE) was established in June 2021 with the purpose of developing approaches to identify and eliminate racial and ethnic bias in home valuations. The Task Force subsequently published the PAVE Action Plan in March 2022, which provided strategies for government and industry to advance equity in property valuation.1 Since the release of the PAVE Action Plan, many stakeholder actions at the federal, state, and local levels have increased awareness of racial bias in home valuations, and there has been increased regulatory and supervisory focus on discriminatory appraisals. The PAVE Action Plan also included strategies and recommendations to improve the data available to study and monitor valuation bias.

As public and private stakeholders continue their efforts to eliminate appraisal bias, the Federal Housing Finance Agency (FHFA) has developed data dashboards and completed research to track progress. On October 24, 2022, FHFA released the Uniform Appraisal Dataset (UAD) Aggregate Statistics with information on property appraisal statistics at the national, metropolitan area, state, county, and neighborhood (i.e., Census tract) levels.2 Using this data, the FHFA blog “Have Racial and Ethnic Valuation Gaps in Home Purchases Narrowed?” explored changes in property appraisal statistics in white and minority neighborhoods over time with a specific focus on timeframes associated with PAVE activities. It found that the appraisal valuation gap continues to exist between white and minority population tracts. However, the data pointed to a reduction in the appraisal gap following the release of the PAVE Action Plan as compared to the time period before the initiation of the PAVE Task Force.

This blog continues to explore changes in property appraisal statistics over time with more updated data and a focus on white, Black and Hispanic/Latino majority neighborhoods.3 Other research has indicated that negative appraisal outcomes are more likely to occur in Black majority and Hispanic/Latino majority neighborhoods as compared to white majority neighborhoods.4 We therefore more directly examine these neighborhoods as a follow-up to our earlier examination of minority and high minority neighborhoods.

To study whether appraisal valuation outcomes between majority white, Black and Hispanic/Latino tracts have changed over time, we divide the UAD Aggregate Statistics quarterly data into two time periods:

- Phase 1: Appraisals conducted from the first quarter of 2013 to the second quarter of 2021, which represents the timeframe of available data before the formation of the PAVE Task Force in June 2021.

- Phase 2: Appraisals conducted from the second quarter of 2022 to the fourth quarter of 2023, which represents the timeframe of available data after the release of the Action Plan in March 2022.5

Appraisals in White, Black and Hispanic/Latino Tracts

Table 1 presents the appraisal counts in each race and ethnicity category. Of the 27.7 million appraisals for purchase properties in the UAD Aggregate Statistics from Q1 2013 through Q4 2023, 20.3 million (73%) were in white majority tracts, 1.0 million (4%) were in Black majority tracts, and 1.5 million (5%) were in Hispanic/Latino majority tracts. Information on tract composition is missing for about three percent of appraisals.

Of the 27.7 million appraisals for purchase properties in the UAD Aggregate Statistics from Q1 2013 through Q4 2023, 21.2 million (77%) occurred in Phase 1, and 4.1 million (15%) occurred in Phase 2 (see Table 1 below).

Table 1: Purchase Appraisal Records (in millions) by Tract Categories

| Period | Black Majority Tracts | Hispanic or Latino Majority Tracts | White Majority Tracts | Total |

|---|---|---|---|---|

| Phase 1 |

0.69 |

1.12 |

15.92 |

21.17 |

| Phase 2 |

0.19 |

0.22 |

2.71 |

4.06 |

| Q1 2013 through Q4 2023 |

0.98 |

1.49 |

20.31 |

27.67 |

Notes: The “Total” in the last column is the sum of the “Black Majority Tracts,” “Hispanic or Latino Majority Tracts”, “White Majority Tracts,” other tract majority race and ethnicity designations, and those with missing racial and ethnicity composition information. Therefore, the sum of the “Black Majority Tracts,” “Hispanic or Latino Majority Tracts”, and “White Majority Tracts” columns will not equal the “Total” column. The period from Q1 2013 through Q4 2023 includes data from Q3 2021 through Q1 2022, when the PAVE Task Force had been formed but the Action Plan had not yet been released.

Appraisal Gap

Appraisal valuation can be at, above, or below the contract price based on the appraiser’s opinion of the value for the property. The appraisal gap is a statistic showing disparities between minority and white tracts, and it is measured as the difference in the proportion of appraisals below the contract price. When the appraised value falls under the contract price, several possible outcomes can occur: the buyer and seller renegotiate the sales price; the buyer pays the difference in cash; the lender commissions a second appraisal; the lender/client requests the appraiser to reconsider the appraised value; or the transaction fails. The Enterprises may acquire loans with appraised values below contract price, and this could affect the terms of the loan at origination.6

In Table 2 below, we present the percentage of appraisals that were equal to, below, or above the contract price for three different time periods across all Census tracts. From Q1 2013 through Q4 2023, 25.9 percent of appraisal valuations were equal to the contract price, 9.2 percent of appraisal valuations were below the contract price (low appraisals), and 64.8 percent were above the contract price (high appraisals). The percentage of both low and high appraisals increased modestly in Phase 2 as compared to Phase 1.

Table 2: Percentage of Purchase Appraisals Equal to, Below, and Above Contract Price

| Period | Equal | Below | Above |

|---|---|---|---|

| Phase 1 |

26.2% |

8.6% |

65.2% |

| Phase 2 |

24.6% |

9.4% |

66.0% |

| Q1 2013 through Q4 2023 |

25.9% |

9.2% |

64.8% |

Table 3 presents the percentage of low appraisals by the three race and ethnicity tract categories for three different timeframes. We also include all appraisals, regardless of tract category. From Q1 2013 through Q4 2023, the percentage of low appraisals was 8.1 percent for appraisals in white majority tracts as compared to 13.9 percent in Black majority tracts and 16.1 percent in Hispanic/Latino majority tracts. The percentage of low appraisals in Black majority tracts is more than one and a half times the percentage in white majority tracts, while in Hispanic/Latino majority tracts that percentage is nearly double. This is a signal of potential racial and ethnic bias in home valuations.

Table 3: Percentage of Low Purchase Appraisals by Tract Categories

| Period | Black Majority Tracts | Hispanic or Latino Majority Tracts | White Majority Tracts | Total |

|---|---|---|---|---|

| Phase 1 |

13.4% |

15.7% |

7.4% |

8.6% |

| Phase 2 |

12.8% |

14.2% |

9.0% |

9.4% |

| Q1 2013 through Q4 2023 |

13.9% |

16.1% |

8.1% |

9.2% |

Notes: The “Total” in the last column includes appraisals in “Black Majority Tracts,” “Hispanic or Latino Majority Tracts”, “White Majority Tracts,” other tract majority race and ethnicity designations, and those with missing racial and ethnicity composition information. Therefore, the sum of the “Black Majority Tracts,” “Hispanic or Latino Majority Tracts”, and “White Majority Tracts” columns will not equal the “Total” column. The timeframe from Q1 2013 through Q4 2023 includes data from Q3 2021 through Q1 2022 when the PAVE Task Force had been formed but the Action Plan had not yet been released.

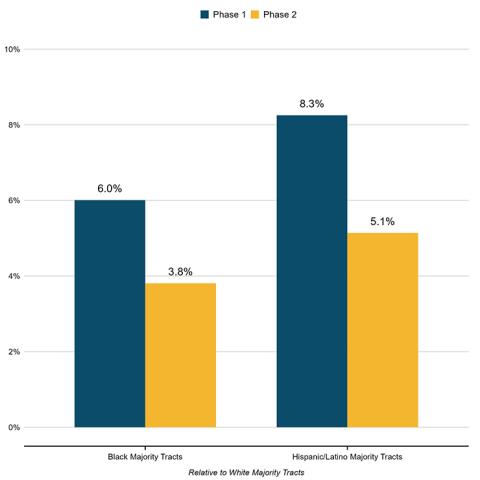

In Phase 1, the percentage of low appraisals was 7.4 percent in white majority tracts, 13.4 percent in Black majority tracts, and 15.7 percent in Hispanic/Latino majority tracts. Thus, the appraisal gap between white and Black majority tracts in Phase 1 was 6.0 percentage points, while the appraisal gap between white and Hispanic/Latino majority tracts was 8.3 percentage points (see Figure 1 below).7

In Phase 2, while the percentage of low appraisals was still higher for Hispanic/Latino and Black majority tracts as compared to white majority tracts, the appraisal gap narrowed because of an increase in the percentage of low appraisals in white majority tracts and a decline in the percentage of low appraisals in Hispanic/Latino and Black majority tracts. Compared to Phase 1, the appraisal gap between white majority tracts and Black majority tracts dropped from 6.0 to 3.8 percentage points, while the appraisal gap between white majority tracts and Hispanic/Latino majority tracts dropped from 8.3 to 5.1 percentage points.8

Figure 1: Appraisal Gap for Black and Hispanic/Latino Majority Tracts Compared to White Majority Tracts Before the PAVE Initiative and After PAVE Action Plan Release

Source: FHFA. Uniform Appraisal Dataset Aggregate Statistics

Notes: Phase 1 includes appraisals conducted through the second quarter of 2021, which reflects the timeframe before the creation of the Interagency PAVE Task Force. Phase 2 includes appraisals starting in the second quarter of 2022, which reflects the timeframe after the release of the PAVE Action Plan.

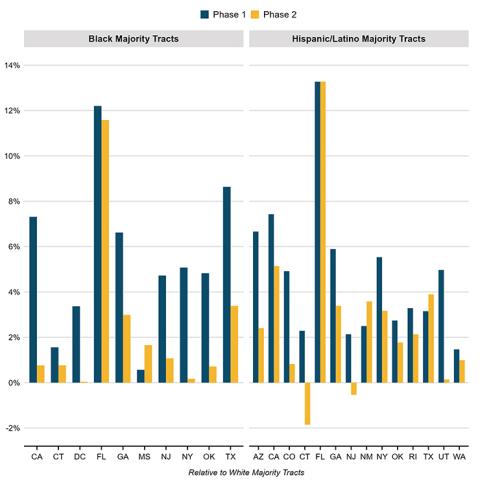

At the state level, the appraisal gap between white majority tracts and both Hispanic/Latino and Black majority tracts declined in nearly all states with data available in Phase 2 as compared to Phase 1, as we show in Figure 2.9 In one state – Mississippi – the appraisal gap between Black majority tracts and white majority tracts increased in Phase 2. In three states – Florida, New Mexico, and Texas – the appraisal gap between Hispanic/Latino majority tracts and white majority tracts increased in Phase 2. For two states – Connecticut and New Jersey – the percentage of low appraisals in Hispanic/Latino majority tracts was lower than the percentage of low appraisals in white majority tracts in Phase 2. In all other states, Hispanic/Latino and Black majority tracts continued to have a higher percentage of low appraisals as compared to white majority tracts, but the gap narrowed substantially for most.

Figure 2: Appraisal Gap Compared to White Majority Tracts Before PAVE Initiative and After PAVE Action Plan Release, by State

Source: FHFA. Uniform Appraisal Dataset Aggregate Statistics

Notes: Phase 1 includes appraisals conducted through the second quarter of 2021, which reflects the time period before the creation of the Interagency PAVE Task Force. Phase 2 includes appraisals starting in the second quarter of 2022, which reflects the time period after the release of the PAVE Action Plan. State-level analysis is based on 10 states for Black majority tracts and 14 states for Hispanic/Latino majority tracts due to the Disclosure Avoidance Techniques adopted by FHFA.

Summary

The UAD Aggregate Statistics data show reduced appraisal gaps between white majority and both Hispanic/Latino and Black majority tracts in the period following the release of the PAVE Action Plan. Further analysis is needed to determine whether this is a causal relationship. The findings in this blog are a promising trend as public and private stakeholders continue their efforts to eliminate home valuation inequities.

Please note that this blog only includes summary statistics available in the UAD Aggregate Statistics without controlling for applicant characteristics. Also, the UAD Aggregate Statistics Data only includes conventional and conforming loans, and appraisal gaps may occur for other lending market segments as well as purchases made without mortgage financing.

Readers are encouraged to explore the Appraisal Gap dashboard and other UAD Aggregate Statistics products on the FHFA website.

References:

1 See https://pave.hud.gov/sites/pave.hud.gov/files/documents/PAVEActionPlan.pdf

2 See https://fhfa.gov/blog/statistics/fhfa-uniform-appraisal-dataset-aggregate-statistics

3 This metric in the UAD Aggregate Statistics indicates the racial or ethnic category that represents 50% or more of the tract population. Tract definitions for Black and Hispanic/Latino include Census populations with more than one race or ethnicity. For example, the Black population includes “Black alone” plus all other combinations of race where Black was identified. If a tract meets criteria for multiple categories, the category is assigned sequentially: Black, then Hispanic/Latino. Non-Hispanic white is not impacted because it excludes all other racial and ethnic populations. This metric is designed to align with Fair Lending race and ethnicity category delineations.

4 https://www.freddiemac.com/fmac-resources/research/pdf/202109-Note-Appraisal-Gap.pdf

5 Multiple research studies were also released since Q2 2021 that increased public awareness of racial bias in home valuations.

6 We acknowledge that the sale price is not always equal to market value, and we expect that in all areas some appraisals will report values lower than the contract price. Properly identifying when a purchase contract price is not supported is an important aspect of an appraisal. However, research data indicate that a high percentage of appraisals are at or above the purchase contract price (Calem, Lambie-Hanson, and Nakamura, 2017). https://www.freddiemac.com/research/pdf/202205-Note-Appraisals-09.pdf

7 Appraisal gap between white and Hispanic majority tracts (Phase 1) = 15.7% – 7.4% = 8.3 percentage points.

8 The similar trend for minority neighborhoods compared to white neighborhoods noted in the FHFA blog "Have Racial and Ethnic Valuation Gaps in Home Purchases

Narrowed?" from August 2023 has continued. Using more current data for Phase 2 with the addition of three quarters of data, the appraisal gap between white tracts and minority tracts grew slightly from 2.9 percent to 3.1 percent between the previous blog’s findings and using data up to Q4 2023. This still represents a significant drop compared to the Phase 1 gap of 5.4 percent. Similarly, the appraisal gap between white tracts and high minority tracts grew slightly from 4.8 percent to 5.1 percent between the previous blog’s finding and using data up to Q4 2023. This still represents a significant drop compared to the Phase 1 gap of 8.7 percent.

9 State-level analysis is based on 10 states for Black majority tracts and 14 states for Hispanic/Latino majority tracts due to the Disclosure Avoidance Techniques adopted by FHFA.

Authors:

By: Christopher W. Davis

Economist

Office of Data and Statistics

Division of Research and Statistics

By: Rashida Dorsey-Johnson

Branch Chief, Statistical Products

Office of the Chief Data Officer

Division of Research and Statistics

By: Diego Saltes

Senior Survey Statistician, Statistical Products Branch

Office of the Chief Data Officer

Division of Research and Statistics

Tagged: FHFA Stats Blog; Aggregate Statistics; Appraisals; Data; Data Dashboards; Open Data; Source: FHFA