Although an appraisal valuation gap continues to exist between white and minority population tracts, data indicate a reduced gap following actions by stakeholders and federal, state, and local agencies, including the release of the PAVE Action Plan. More analysis is needed to determine whether this is a causal relationship.

Introduction

In June 2021, the federal Interagency Task Force on Property Appraisal and Valuation Equity (PAVE) was created to develop strategies to identify and eliminate racial and ethnic bias in home valuations. On March 23, 2022, Task Force members released the PAVE Action Plan to advance property appraisal and valuation equity.1 On October 24, 2022, the Federal Housing Finance Agency (FHFA) released Uniform Appraisal Dataset (UAD) Aggregate Statistics with information on property appraisal statistics at the national, metropolitan area, state, county, and neighborhood (i.e., census tract) levels. Since June 2021, multiple other actions taken by stakeholders (such as publishing research and initiating legal proceedings) and federal, state, and local agencies have increased awareness of racial bias in home valuations and have increased enforcement of prohibitions on discriminatory appraisals.

On June 29, 2023, FHFA released its fourth quarterly UAD Aggregate Statistics, including a new “Appraisal Gap” dashboard highlighting potential bias in appraisals. In this blog, we use a subset of the data to explore changes in property appraisal statistics in white and minority neighborhoods.

We use the three categories available in the UAD Aggregate Statistics based on the percentage of minority population in the census tract to study racial and ethnic valuation gaps. Specifically, if the property being appraised is in a census tract where the percentage of minority population is less than or equal to 50 percent, it is flagged as an appraisal in a white tract; and if the percentage of minority population is more than 50 percent, it is flagged as an appraisal in a minority tract. Additionally, we flag census tracts with more than 80 percent minority population as high minority tracts. Table 1 presents the appraisal counts in each category. Of the 25.9 million appraisals for purchase properties in the UAD Aggregate Statistics, 19.3 million (74 percent) were in white tracts, and 6.1 million (23 percent) were in minority tracts. Information on tract composition is missing for about 3 percent of appraisals.

To study whether the appraisal valuation outcomes between white tracts and two minority tract categories have changed over time, we divide the quarterly data into two time periods:

- Phase 1: Appraisals conducted prior to the second quarter of 2021, before the creation of the Interagency PAVE Task Force in June 2021.

- Phase 2: Appraisals conducted following the first quarter of 2022, after the release of the Action Plan in March 2022.2

Of the 25.9 million appraisals for purchase properties in the UAD Aggregate Statistics from 2013 Q1 through 2023 Q1, 21.1 million (81 percent) occurred in Phase 1, and 2.4 million (8 percent) occurred in Phase 2. (See Table 1 below.)

Table 1: Appraisal Records (in millions) by Tract Categories

| Period | High Minority Tracts | Minority Tracts | White Tracts | Total |

|---|---|---|---|---|

| Phase 1 | 1.37 | 4.89 | 15.92 | 21.06 |

| Phase 2 | 0.18 | 0.58 | 1.66 | 2.43 |

| Total | 1.73 | 6.05 | 19.26 | 25.91 |

Note: “High Minority Tracts” are a subset of the “Minority Tracts.” Thus, the “Total” in the last column is the sum of the “Minority Tracts,” “White Tracts,” data from tracts with missing racial and ethnicity composition information, and data from Q2 2021 through Q1 2022 when the PAVE Task Force had been formed but had not yet released the Action Plan.

Appraisal Gap

Appraisal valuation can be at, above, or below contract price based on the appraiser’s opinion of value for the property. However, unlike appraisals that are at or above the contract price, low appraisals can delay or even derail the closing of the sale. For instance, a buyer can back out of the contract if the purchase agreement has an appraisal clause. A low appraisal may limit the amount a lender is willing to finance, which may require the seller and/or the buyer to cover the shortfall. The seller may have to cover at least part of the shortfall through reducing the contract price. Thus, a low appraisal can reduce the equity gain on the property for the seller.

In Table 2 below, we present the percentage of appraisals that were equal to, below, or above the contract price for three different time periods across all census tracts. From Q1 2013 through Q1 2023, nearly 26 percent of the appraisal valuation was equal to the contract price, 9.2 percent of appraisals were below the contract price (low appraisals), and 64.7 percent were above the contract price (high appraisals). The percentage of both the low and the high appraisals increased in Phase 2 as compared to Phase 1.

Table 2: Percentage of Appraisals Equal to, Above, and Below Contract Price

| Period | Equal | Below | Above |

|---|---|---|---|

| Q1 2013 through Q1 2023 | 26.0% | 9.2% | 64.7% |

| Phase 1 | 26.2% | 8.6% | 65.1% |

| Phase 2 | 24.3% | 9.7% | 66.0% |

While the percentage of low appraisals is in single digits across all census tracts, in Table 3 below, we present the percentage of low appraisals by the three tract categories for three different time periods. From Q1 2013 through Q1 2023, the percentage of low appraisals was 8.1 percent for properties in white tracts as compared to 13.4 percent in minority tracts and 16.5 percent in high minority tracts. The more than double the percentage of low appraisals in high minority tracts as compared to white tracts is a signal of potential racial and ethnic bias in home valuations. Because we know that there is some anchoring effect for appraised values at or near the contract price, appraisal gap (percentage point difference between low appraisals between the tract categories) makes for a stronger inference of bias in both the raw statistic and when controlling for explanatory factors.

Table 3: Percentage of Low Appraisals by Tract Categories

| Tract | Q1 2013 - Q1 2023 | Phase 1 | Phase 2 |

|---|---|---|---|

| White | 8.1% | 7.4% | 9.3% |

| Minority | 13.4% | 12.8% | 12.2% |

| High Minority | 16.5% | 16.1% | 14.1% |

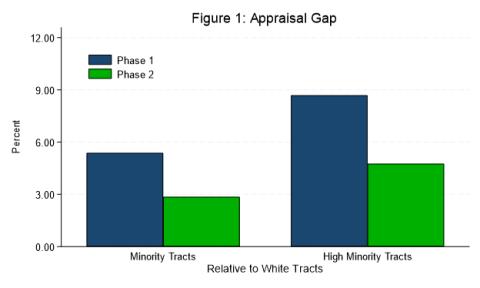

In Phase 1, the percentage of low appraisals was 7.4 percent in white tracts, 12.8 percent in minority tracts, and 16.1 percent in the high minority tracts. Thus, the appraisal gap between white and minority tracts in Phase 1 was 5.4 percentage points. The appraisal gap between white and high minority tracts was 8.7 percentage points (see Figure 1 below).3

In Phase 2, while the percentage of low appraisals is still higher for minority and high minority tracts as compared to white tracts, the appraisal gap narrowed because of an increase in the percentage of low appraisals in white tracts and a subsequent decline in the percentage of low appraisals in minority tracts. The appraisal gap between white and minority tracts dropped to 2.9 percentage points while the appraisal gap between white and high minority tracts dropped to 4.8 percentage points.

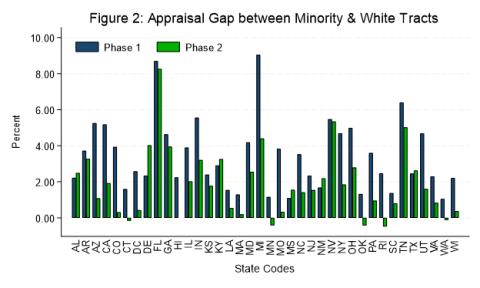

At the state level, the appraisal gap between minority and white tracts declined in nearly all states in Phase 2 as compared to Phase 1, as we show in Figure 2.4 In six states – Alabama, Delaware, Kentucky, Mississippi, New Mexico, and Texas – the appraisal gap between minority and white tracts increased in Phase 2. In five states – Connecticut, Minnesota, Oklahoma, Rhode Island, and Washington – the percentage of low appraisals in minority tracts was lower than the percentage of low appraisals in white tracts in Phase 2. In all other states, minority tracts continued to have a higher percentage of low appraisals as compared to white tracts but the gap narrowed substantially.

Summary

In conclusion, UAD Aggregate Statistics data show a reduced appraisal gap in the period following the release of the PAVE Action Plan. More analysis is needed to determine whether this is a causal relationship, but it nonetheless represents an encouraging trend as public and private stakeholders continue their efforts to eliminate appraisal bias.

Please note that we only looked at summary statistics available in the UAD Aggregate Statistics without controlling for applicant characteristics. Also, the UAD Aggregate Statistics Data only includes conventional and conforming loans, and gaps may occur for other lending market segments as well as purchases made without mortgage financing.

Readers are encouraged to explore the new Appraisal Gap dashboards and other UAD Aggregate Statistics products on the FHFA website.

References:

1 https://pave.hud.gov/actionplan

2 Multiple research studies were also released since Q2 2021 that increased public awareness of racial bias in home valuations.

3 Appraisal gap between white and high minority tracts (Phase 1) = 16.1 – 7.4 = 8.7.

4 State-level analysis is based on 37 states and the District of Columbia due to the Disclosure Avoidance Techniques adopted by FHFA.

* This blog was updated on April 12, 2024, to clarify that Phase 1 data are inclusive of the second quarter of 2021.

By: Anju Vajja

FHFA Research Officer

Division of Research and Statistics

Tagged: FHFA Stats Blog; Aggregate Statistics; Appraisals; Data; Data Dashboards; Open Data; Source: FHFA