The Federal Housing Finance Agency (FHFA) is an independent agency that was established by the Housing and Economic Recovery Act of 2008 (HERA). The agency is responsible for the effective supervision, regulation, and oversight of the housing mission of the Federal National Mortgage Association (Fannie Mae), the Federal Home Loan Mortgage Corporation (Freddie Mac), and the Federal Home Loan Bank System, which includes the 11 Federal Home Loan Banks (FHLBanks) and the Office of Finance (OF). The FHFA's mission is to ensure that Fannie Mae and Freddie Mac (the Enterprises) and the FHLBanks (together, "the regulated entities") fulfill their mission by operating in a safe and sound manner to serve as a reliable source of liquidity and funding for housing finance and community investment. Since 2008, FHFA has also served as conservator of Fannie Mae and Freddie Mac.

Our Mission

Ensure the regulated entities fulfill their mission by operating in a safe and sound manner to serve as a reliable source of liquidity and funding for the housing finance market throughout the economic cycle.

Our Vision

For FHFA’s supervisory, regulatory, and mission-related activities to support a reliable, stable, equitable, and liquid U.S. housing finance system.

Our Strategic Goals

- Ensuring safe and sound regulated entities through world-class supervision;

- Fostering competitive, liquid, efficient, and resilient (CLEAR) national housing finance markets; and

- Positioning the Agency as a model of operational excellence by strengthening its workforce and infrastructure.

Our Values

-

Fairness

We value varied perspectives and thoughts and treat others with impartiality.

-

Integrity

We are committed to the highest ethical and professional standards to inspire trust and confidence in our work and in one another.

-

Accountability

We are responsible for carrying out our work with transparency and professional excellence.

-

Respect

We treat others with dignity, share information and resources, and collaborate.

Oversight

Together, Fannie Mae, Freddie Mac, and the FHLBank System provide more than $8.1 trillion in funding for the U.S. mortgage markets and financial institutions.

Managing the Conservatorships of Fannie Mae and Freddie Mac

In addition to prudential supervision and regulation of Fannie Mae and Freddie Mac, since 2008 FHFA has overseen the conservatorships of the Enterprises, in part through a scorecard that FHFA releases annually.

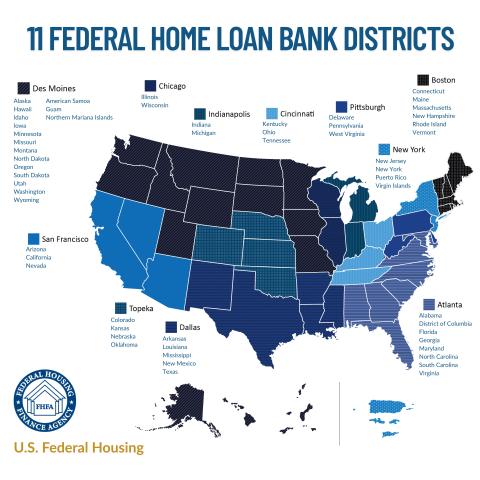

Federal Home Loan Bank System

The Federal Home Loan Bank System was created by the Federal Home Loan Bank Act as a government sponsored enterprise to support mortgage lending and related community investment.

The FHLBank System provides its members (thrift institutions, commercial banks, credit unions, insurance companies, and certified community development financial institutions) with a source of funding for mortgages and asset-liability management, liquidity for their short-term needs, and additional funds for housing finance and community development. Approximately 80 percent of U.S. lending institutions rely on the FHLBanks.

FHFA conducts annual examinations and regular monitoring of the FHLBanks and the Office of Finance. In addition, FHFA oversees the FHLBanks' affordable housing and community investment activities. This includes FHLBank allocations for the Affordable Housing Program, which provides funding for affordable rental housing and down payment assistance.

View PDF version of 11 Federal Home Loan Bank Districts map.

Financial Stability Oversight Council

FHFA is a member agency of the Financial Stability Oversight Council. The Council is charged with identifying risks to the financial stability of the United States, promoting market discipline, and responding to emerging risks to the stability of the U.S. financial system.

The Council has 15 members. In addition to the Director of FHFA, the Council members are:

- the Secretary of the Treasury who serves as the Chair of the Council;

- the Chairman of the Board of Governors of the Federal Reserve System;

- the Comptroller of the Currency (OCC);

- the Director of the Consumer Financial Protection Bureau (CFPB);

- the Chairman of the Securities and Exchange Commission (SEC);

- the Chairman of the Federal Deposit Insurance Corporation (FDIC);

- the Chairman of the Commodity Futures Trading Commission (CFTC);

- the Chairman of the National Credit Union Administration (NCUA);

- an independent member with insurance expertise who is appointed by the President and confirmed by the Senate for a six-year term.

- the Director of the Office of Financial Research;

- the Director of the Federal Insurance Office;

- a state insurance commissioner designated by the state insurance commissioners;

- a state banking supervisor designated by the state banking supervisors; and

- a state securities commissioner (or officer performing like functions) designated by the state securities commissioners.

Page last updated: March 8, 2024