Fannie Mae & Freddie Mac

Enterprise Housing Goals

The Federal Housing Enterprises Financial Safety and Soundness Act of 1992, as amended by the Housing and Economic Recovery Act of 2008, requires the setting of annual housing goals for Fannie Mae and Freddie Mac and the monitoring of performance in achieving these goals. FHFA sets and monitors the performance on meeting the established goals. Learn more about the Enterprise housing goals here.

Duty to Serve

The Duty to Serve (DTS) requires Fannie Mae and Freddie Mac (Enterprises) to facilitate a secondary market for mortgages on housing for very low-, low-, and moderate-income families in: Manufactured housing, Affordable housing preservation, and Rural housing. To learn more about Duty to Serve, click here.

Federal Home Loan Bank System

The Federal Home Loan Bank (FHLB) system was created by the Federal Home Loan Bank Act of 1932 as a government sponsored enterprise to support mortgage lending and related community investment. It is composed of 11 FHLBanks, more than 6,700 member financial institutions, and the System's fiscal agent, the Office of Finance. Each FHLBank is a separate, government-chartered, member-owned corporation.

Federal Home Loan Bank Community Lending Plans

The Programs

2023 FHLBank Targeted Mission Activities Report

2022 FHLBank Targeted Mission Activities Report

Affordable Housing Program (AHP)

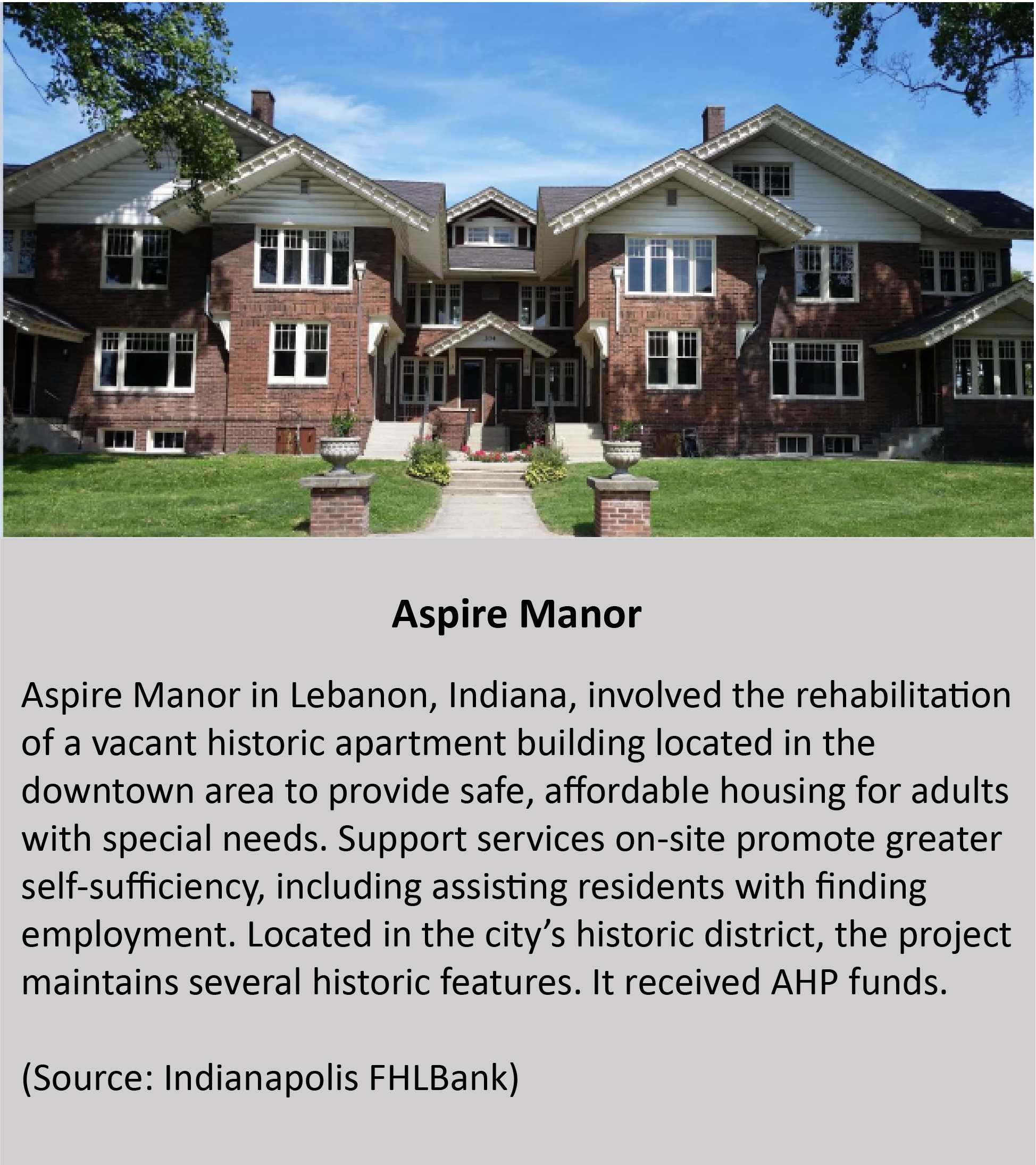

From 1990, when the AHP was authorized, through 2023, the FHLBanks have awarded approximately $8 billion in funding, supporting approximately 1.1 million housing units. On November 20, 2018 FHFA issued a final rule amending its regulation on the FHLBanks' Affordable Housing Program. To learn more about AHP click here.

Community Investment Program (CIP)

In 2023, the FHLBanks issued approximately $4.2 billion in Community Investment Program advances for housing projects and almost $270.7 million for economic development projects. To learn more about CIP click here.

Community Investment Cash Advance (CICA)

In 2023, the FHLBanks issued approximately $2.6 billion in Community Investment Cash Advance advances for such projects as commercial, industrial, manufacturing, social services, and public facilities. To learn more about CICA click here.

Community Support Program (CSP)

The FHLBank Act requires FHFA to establish standards of community investment or service for members of the FHLBanks to maintain continued access to long-term FHLBank advances. The CSP requires each FHLBank member (except for non-depository CDFIs) to submit a Community Support Statement to FHFA once every two years. The Community Support Statement serves to document a FHLBank member's Community Reinvestment Act of 1977 (CRA) performance and support of first-time homebuyers. To learn more about CSP click here.

Community Development Financial Institution (CDFI) Membership

CDFIs are specially designated financial institutions that serve markets underserved by traditional financial institutions. To learn about CDFI Membership click here.

Housing Goals

The FHLBanks purchase loans from their members under the acquired member assets program, a whole loan mortgage purchase program. The FHLBanks' housing goals performance is based on single-family whole loans purchased through their acquired member assets programs. In 2023, 9 of 11 FHLBanks purchased whole loans through those programs. To learn more about Housing Goals click here.

Page Last Updated: November 15, 2024