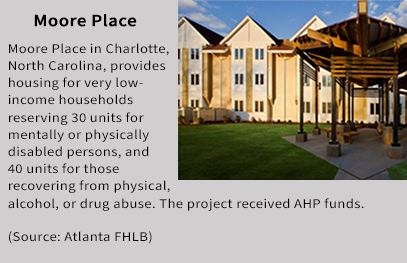

By law, each FHLBank must establish an Affordable Housing Program (AHP), and must contribute 10 percent of its earnings to its AHP.

Under the Federal Home Loan Bank Act (FHLBank Act), the specified uses of AHP funds are to finance the purchase, construction, or rehabilitation of owner-occupied housing for low- or moderate-income households (with incomes at 80 percent or less of the area median income), and the purchase, construction, or rehabilitation of rental housing where at least 20 percent of the units are affordable for and occupied by very low-income households (with incomes at 50 percent or less of the area median income). The AHP leverages other types of financing, and supports affordable housing for special needs and homeless families, among other groups.

The FHLBanks are authorized to operate two programs:

-

Competitive Application Program - A financial institution member of a FHLBank submits an application for AHP funds to the FHLBank on behalf of a non-profit or for-profit sponsor and is evaluated in comparison to other applications under the FHLBank's scoring system. The FHLBank approves the applications in descending ranking order starting with the highest scoring application.

-

Homeownership Set-Aside Program - FHLBanks make grants available to their financial institution members, who provide the funds as down payment, closing cost, or counseling assistance to homebuyers, or as rehabilitation assistance to homeowners. Establishment of homeownership set-aside programs is elective for each FHLBank. FHFA's regulation limits the amount of funds that a FHLBank may allocate annually to its set-aside program.

Image

-

AHP Amendments

FHFA has issued the final rule amending the AHP regulation. To learn more, explore our webinar recording, slides, and transcript.

AHP Technical Revisions

FHFA has issued technical revisions to the AHP regulation. These technical revisions are consistent with FHFA’s policy intent, as reflected in the preamble of the 2018 final rule amendments, and do not involve any policy changes.

AHP Homeownership Proxy

FHFA has issued an Advisory Bulletin on proxies in AHP homeownership transactions. Explore the HUD HOME and HTF Homeownership Value Limits and proxy instructions.

AHP Homeownership Set-Aside Program Maximum Per-Household Subsidy Limit

The AHP regulation establishes a maximum per-household subsidy limit of $22,000 per household for a FHLBank’s Homeownership Set-Aside Programs, subject to upward adjustments of the subsidy limit on an annual basis in accordance with increases in FHFA’s House Price Index (HPI). In the event of a decrease in the HPI in any year, the maximum subsidy limit remains at the then-current amount until the HPI increases above that amount, at which point the subsidy limit adjusts to that higher amount. 12 CFR 1291.42(c).

View the AHP Homeownership Set-Aside Program Maximum Per-Household Subsidy Limits:

- 2026 - effective January 1, 2026

- 2025 - effective January 1, 2025

- 2024 - effective January 1, 2024

- 2023 - effective January 1, 2023

- 2022 - effective January 1, 2022

The most recent subsidy limit remains in effect until FHFA issues notice of an increase to the limit.

Other Documents

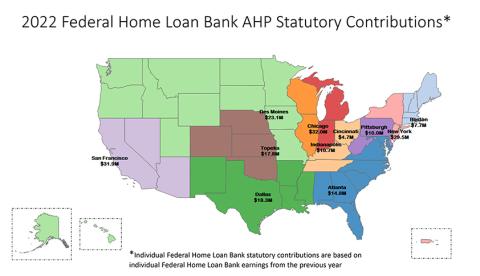

View Federal Home Loan Bank Statutory AHP Contributions for Prior Years:

Community Investment Program (CIP)

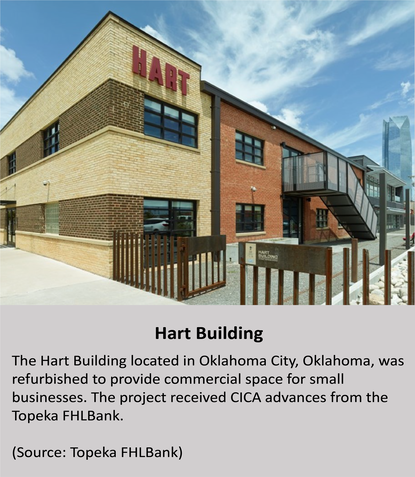

The FHLBank Act also requires each FHLBank to offer Community Investment Program advances (i.e., loans) to their member financial institutions. The FHLBanks' CIP advances finance housing for households with incomes up to 115 percent of the area median income or commercial and economic development activities that benefit low- and moderate-income families (defined as 80 percent or less of area median income) or activities located in low- and moderate-income neighborhoods (where 51 percent or more of the households are low- or moderate-income).

Community Development Cash Advance for Targeted Economic Development

The FHLBanks offer advances for targeted economic development under the Community Investment Cash Advance (CICA) program, which is authorized by FHFA regulation. CICA programs offer funding for FHLBank members to provide financing for projects that are targeted to certain economic development activities. CICA lending is targeted to specific beneficiaries, including small businesses and certain geographic areas. CICA funding in urban areas is for targeted beneficiaries with incomes at or below 100 percent of the area median income and CICA funding in rural areas is for targeted beneficiaries with incomes at or below 115 percent of the area median income.

FHFA approval letter paves way for more businesses to get help through the FHLBanks’ Community Investment Cash Advance (CICA) programs. CICA eligibility will align with the Paycheck Protection Program at least through 12/31/20.