The Federal Housing Finance Agency (FHFA) undertook an extensive evaluation to determine whether to implement a Principal Reduction Modification program for seriously delinquent, underwater borrowers whose loans are owned or guaranteed by Fannie Mae or Freddie Mac (the Enterprises). FHFA’s objective was to develop a program that helped targeted borrowers avoid foreclosure while also adhering to FHFA’s mandate to preserve and conserve the assets of the Enterprises.

Am I Eligible?

Your loan must be owned or guaranteed by Fannie Mae or Freddie Mac and meet basic criteria.

- At least 90 days delinquent as of March 1, 2016

- Unpaid principal balance of $250,000 or less as of March 1, 2016

- Owner-occupied

- Loan-to-value ratio exceeds 115%

- Generally meet other Streamlined Modification eligibility criteria

Resources

Internal Revenue Service Guidance on Tax Treatment of Principal Reduction Modifications (Notice 2016-72) (12/5/2016)

Principal Reduction Modification Borrower Event Handout (8/2/2016)

Principal Reduction Modification FAQs for Congressional Staff (7/11/2016)

Principal Reduction Modification FAQs for Housing Counselors (7/11/2016)

Principal Reduction Modification General FAQs (4/14/2016 revised 12/5/2016)

Background

News Release: FHFA Announces Principal Reduction Modification Program and Further Enhancements to Non-Performing Loan Sales Requirements (4/14/2016)

Fact Sheet: Principal Reduction Modification (4/14/2016)

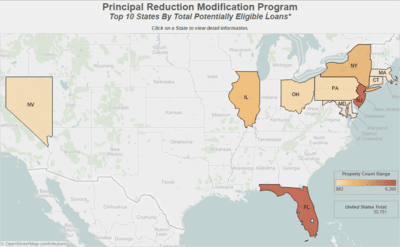

FHFA Blog: FHFA Launches Map of Potentially Eligible Borrowers for Principal Reduction Modification (7/11/2016)

FHFA Blog: A Message to Borrowers Struggling With Mortgage Debt: Check Your Mail! (10/4/2016)

Letters & FAQs

Did you receive a Solicitation Letter in the mail from Fannie Mae or Freddie Mac? If so, you may be eligible for Principle Reduction Modification.

Protect Yourself From Scams

Scams are a growing problem that could cost you thousands of dollars — or even your home. Remember that real help is free. There should be no fees in exchange for counseling services. If you think you have been scammed, visit these sites for more information and to file a complaint today: