FHFA FINAL RULE TO AMEND THE ENTERPRISE REGULATORY CAPITAL FRAMEWORKBACKGROUNDThe Housing and Economic Recovery Act of 2008 amended the Federal Housing Enterprises Financial Safety and Soundness Act of 1992 to require the Federal Housing Finance Agency (FHFA) to establish, by regulation, risk-based capital requirements for Fannie Mae and Freddie Mac (the Enterprises) to ensure that each Enterprise operates in a safe and sound manner, maintaining sufficient capital and reserves to support the risks that arise in the operations and management of the Enterprises. On December 17, 2020, FHFA published a final rule to establish the Enterprise Regulatory Capital Framework (ERCF). FHFA is now adopting a final rule that amends the ERCF by refining the prescribed leverage buffer amount (PLBA or leverage buffer) and the risk-based capital treatment of credit risk transfer (CRT) exposures. These amendments will facilitate an environment where the leverage capital requirement and buffer are a credible backstop to the risk-based capital requirements and buffers and where the Enterprises have incentives to distribute acquired credit risk to private investors through CRT rather than to buy and hold that risk. SUMMARY OF THE FINAL RULEChanges to the Leverage Buffer The ERCF requires an Enterprise to maintain a leverage ratio of tier 1 capital to adjusted total assets (ATA) of at least 2.5 percent. In addition, to avoid limits on capital distributions and discretionary bonus payments, an Enterprise must also maintain a tier 1 capital leverage buffer in excess of the leverage ratio requirement. FHFA is revising the determination of the leverage buffer because a leverage framework that serves as the binding capital constraint in most economic scenarios could lead to undesirable outcomes at the Enterprises, including promoting risk-taking and creating disincentives for CRT and other forms of risk transfer. The final rule replaces the fixed 1.5 percent leverage buffer with a dynamic leverage buffer determined annually and equal to 50 percent of an Enterprise’s stability capital buffer. The final rule supports the primary purpose of the leverage framework to serve as a credible backstop to the risk-based capital framework. Such an environment will provide the Enterprises with incentives to shed risk using CRT. In addition, the final rule more closely aligns the ERCF with an approach implemented internationally in the Basel Accords with respect to leverage requirements for global systemically important banks. Changes to Credit Risk Transfer Risk-based Capital Treatment FHFA views the transfer of risk of unexpected credit losses to a broad set of global investors as an important tool to reduce taxpayer exposure to the risks posed by the Enterprises and to mitigate systemic risk to the housing finance market caused by the size and monoline nature of the Enterprises’ businesses. CRT is an effective, resilient, and cost-effective mechanism for such a distribution of unexpected credit risk, especially while the Enterprises are in conservatorships and have inadequate capital positions relative to their overall books of business. Since the CRT programs were implemented in 2013, CRT transactions have reduced the systemic risk posed by the Enterprises, protected taxpayers from potentially large credit-related losses, increased secondary market liquidity, and promoted market stability by distributing credit risk broadly across the global financial system. The final rule revises the risk-based capital treatment for retained CRT exposures by replacing the 10 percent prudential risk weight floor on these exposures with a 5 percent risk weight floor. This addresses concerns that the current floor unduly decreases the capital relief afforded to CRT and reduces the Enterprises’ incentives to engage in CRT. The final rule also removes the largely duplicative requirement that an Enterprise must apply an overall effectiveness adjustment to its retained CRT exposures. FHFA has determined that these refinements will further encourage the use of CRT without increasing the safety and soundness, mission, and housing stability risks posed by some CRT.[1] Estimated Capital Requirements and Buffers under the Final Rule The final rule would require the Enterprises to maintain significant levels of capital to satisfy their risk-based and leverage capital requirements and buffers. Based on their financial condition as of September 30, 2021, the Enterprises together would be required to hold approximately $319 billion in adjusted total capital, of which at least $270 billion would need to be tier 1 capital and $234 billion would need to be common equity tier 1 capital (CET1). For both Enterprises, estimated tier 1 risk-based capital requirements plus buffers would exceed estimated leverage capital requirements plus buffers as of this date, providing the Enterprises with incentives to manage their capital and potentially reduce risk to taxpayers using CRT. Fannie Mae’s tier 1 risk-based capital requirement plus buffer of $196 billion (4.4 percent of ATA) exceeds their tier 1 leverage capital requirement plus buffer of $133 billion (3.0 percent of ATA). Freddie Mac’s tier 1 risk-based capital requirement plus buffer of $104 billion (3.0 percent of ATA) exceeds their tier 1 leverage capital requirement plus buffer of $97 billion (2.8 percent of ATA). | SUMMARYThe final rule includes three areas of refinement to the current capital rule:

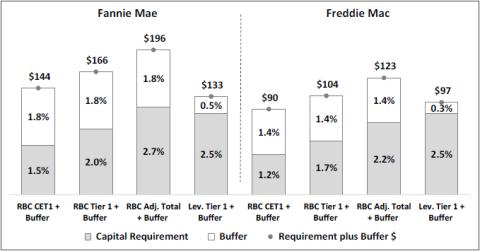

The final rule also implements technical corrections to the ERCF published on December 17, 2020.

|

Estimated Enterprise Capital Requirements and Buffers relative to Adjusted Total Assets as of September 30, 2021 ($ in billions) Image

| |

[1] To provide additional transparency into the risk-based capital calculations for CRT, an updated CRT spreadsheet tool can be found on FHFA’s website: Enterprise-Capital-CRT-Tool-02252022.xlsx. | |

Contacts: