The Federal Home Loan Bank System was created by the Federal Home Loan Bank Act as a government sponsored enterprise to support mortgage lending and related community investment.

It is composed of 11 regional FHLBanks, about 6,800 member financial institutions, and the System’s fiscal agent, the Office of Finance. Each FHLBank is a separate, government-chartered, member-owned corporation.

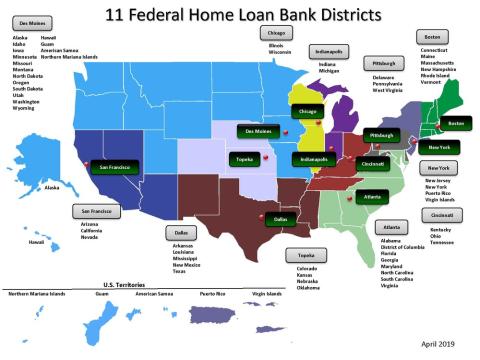

The 11 Regional Federal Home Loan Banks

There are regional FHLBanks located in: Atlanta, Boston, Chicago, Cincinnati, Dallas, Des Moines, Indianapolis, New York, Pittsburgh, San Francisco, and Topeka. See FHLBank Districts.

View PDF version of 11 Federal Home Loan Bank Districts map.

What the Federal Home Loan Bank System Does

The FHLBanks have been a fundamental part of the nation's financial system for more than eight decades. The System provides its members (members include thrift institutions, commercial banks, credit unions, insurance companies, and certified community development financial institutions, with a source of funding for mortgages and asset-liability management; liquidity for a member's short-term needs; and additional funds for housing finance and community development.

The FHLBanks provide long- and short-term advances (loans) to their members. Advances are primarily collateralized by residential mortgage loans, and government and agency securities. Community financial institutions may pledge small business, small farm, and small agri-business loans as collateral for advances. Advances are priced at a small spread over comparable U.S. Department of the Treasury obligations.

While the FHLBanks' mandate reflects a public purpose, all 11 regional FHLBanks are privately capitalized and receive no appropriated federal funds.

Consolidated Obligations

The FHLBanks fund themselves principally by issuing consolidated obligations of the System in the public capital markets through the Office of Finance, which acts as the FHLBanks' agent. Although each FHLBank is a separate corporate entity with its own management and board of directors, the FHLBanks are jointly and severally liable for all System consolidated obligation debt. Consolidated obligations consist of bonds and discount notes (original maturity of less than one year and sold at a discount). Consolidated obligations are not guaranteed or insured by the federal government. However, the FHLBanks’ status as a government-sponsored enterprise accords certain privileges and enables the FHLBanks to raise funds at rates slightly above comparable obligations issued by the U.S. Department of the Treasury.

Bank Membership

FHLBank members include thrift institutions, commercial banks, credit unions, insurance companies, and certified community development financial institutions. A financial institution joins the FHLBank district that serves the state where the institution's home office or principal place of business is located. A financial institution may become a member by meeting certain statutory requirements:

- be duly organized under the laws of any state of the United States;

- be subject to inspection and regulation under the banking laws, or similar state or federal laws;

- make long-term home mortgage loans;

- have at least 10 percent of its total assets in residential mortgage loans, if it is a federally insured depository institution (community financial institutions which are exempt from this requirement);

- have a financial condition that allows FHLBank advances (loans) to be made safely;

- have character of management and a home financing policy consistent with sound and economical home financing.

Each member of the FHLBank must maintain a minimum investment in the stock of the FHLBank. The minimum investment is established by each FHLBank, and the sum of the stock investment by all members must be sufficient for the FHLBank to meet its own minimum capital requirement. Contact the FHLBank for more information concerning minimum stock requirement.

Bank Directors

The FHLBanks are governed by boards of directors ranging in size from 14 to 22 directors, all of whom are elected by member institutions. The majority of the FHLBank board members are directors or officers of member institutions, while the remaining directors (at least 40 percent) are independent. Independent directors are those who are not officers of an FHLBank or directors, officers, or employees of a member institution.

To fill in and download an Independent Director Application form click here, to fill in and download an Independent Director Annual Certification form click here and to fill in and download a Member Director Eligibility Certification form click here. For instructions on locking the information that the FHLBanks are instructed to complete on the first page of each of the Forms click here to download the Locking Fillable PDF Field to Read Only document.

(Forms provided here expire 7/31/24)

Read about Directors' Executive Compensation.