Washington, D.C. – The Federal Housing Finance Agency (FHFA) today released the first set of national statistics derived from the National Mortgage Database (NMDB®) as a step toward implementing the monthly mortgage market survey public data disclosure required by the Housing and Economic Recovery Act of 2008 (HERA). FHFA will continue to assess whether additional data may be released that meets the statutory requirements under HERA.

The NMDB contains information for a nationally representative sample of residential mortgages in the U.S. The select summary statistics from the NMDB describe loan characteristics for various loan groups. The statistics also describe various loan types, including loan size, borrower credit scores, home values, down payments and other product features. These statistics provide useful benchmarks for the residential mortgage market.

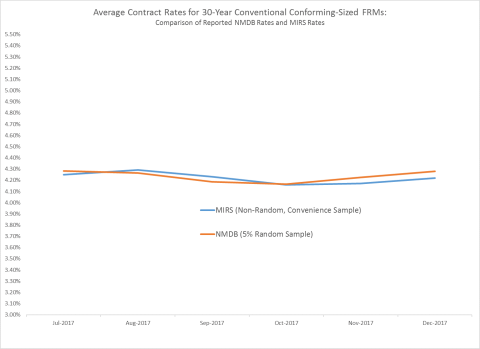

The data released today supplements FHFA's regular Monthly Interest Rate Survey (MIRS), which also provides information on select loans. The MIRS publications include data on loans more quickly after origination, as the summarized loans are originated in the prior month. Although the NMDB data statistics require additional time to finalize following origination, the NMDB data statistics are produced using a much larger data sample—and, importantly, a sample that has been randomly selected. The MIRS data have not been randomly selected.

Despite the sampling differences, the NMDB and MIRS statistics “overlap" in some of the variables summarized. This publication and future NMDB data releases will compare trends in select statistics from the various datasets. The next release of NMDB statistics for the first quarter of 2018 will be in March 2019.

The NMDB, launched in 2012, is a joint effort with FHFA and the Bureau of Consumer Financial Protection (BCFP) and is the first comprehensive repository of detailed mortgage loan information designed to support policymaking and research efforts and to help regulators better understand emerging mortgage and housing market trends.

Link to NMDB statistics for July – December 2017: www.fhfa.gov/nmdbdata

The average interest rate on conventional, 30-year, conforming-sized fixed-rate mortgages was 4.3 percent in December 2017, up 10 basis points from 4.2 in November 2017.

The average share of conventional mortgage loans with loan-to-value ratio greater than 90 percent was 26.6 percent in December 2017, down 10 basis points from 26.7 in November 2017.

Media: Stefanie Johnson (202) 649-3030 / Corinne Russell (202) 649-3032

Consumers: Consumer Communications or (202) 649-3811