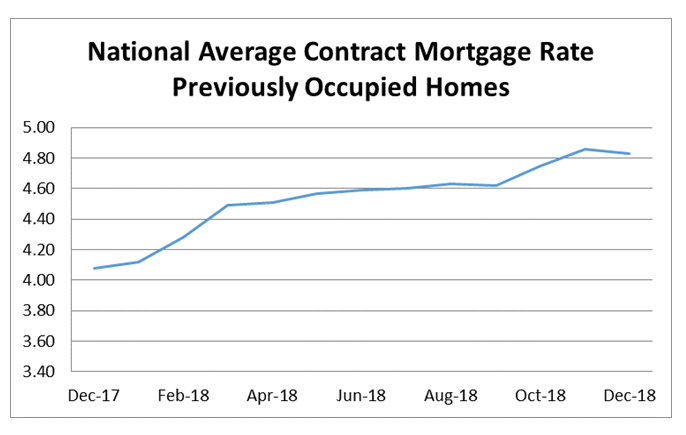

Washington, D.C. - Nationally, interest rates on conventional purchase-money mortgages were nearly flat from November to December, according to several indices of new mortgage contracts.

The National Average Contract Mortgage Rate for the Purchase of Previously Occupied Homes by Combined Lenders Index was 4.83 percent for loans closed in late December, down 3 basis points from 4.86 percent in November.

The average interest rate on all mortgage loans was 4.82 percent, unchanged from November.

The average interest rate on conventional, 30-year, fixed-rate mortgages of $453,100 or less was 4.98 percent, down 1 basis point from 4.99 in November.

The effective interest rate on all mortgage loans was 4.92 percent in December, up 1 basis point from 4.91 in November. The effective interest rate accounts for the addition of initial fees and charges over the life of the mortgage.

The average loan amount for all loans was $318,600 in December, unchanged from November.

FHFA will release January index values Thursday, February 28, 2019.

For more information, call David Roderer at (202) 649-3206. To hear recorded index information, call (202) 649-3993. To find the complete contract rate series, go to https://www.fhfa.gov/data/mirs.

Source: FHFA

Technical note: The indices are based on a small monthly survey of mortgage lenders, which may not be representative. The sample is not a statistical sample but is rather a convenience sample. Survey respondents were asked to report terms and conditions of all conventional, single-family, fully amortized purchase-money loans closed during the last five working days of the month. Unless otherwise specified, the indices include 15-year mortgages and adjustable-rate mortgages. The indices do not include mortgages guaranteed or insured by either the Federal Housing Administration or the U.S. Department of Veterans Affairs. The indices also exclude refinancing loans and balloon loans. December 2018 values are based on 3,545 reported loans from 13 lenders, which include savings associations, mortgage companies, commercial banks, and mutual savings banks.

Media: Corinne Russell (202) 649-3032 / Stefanie Johnson (202) 649-3030

Consumers: Consumer Communications or (202) 649-3811