|

BACKGROUND FHFA has published a final rule implementing Section 310 of the Economic Growth, Regulatory Relief, and Consumer Protection Act of 2018 (Public Law 115-174) (the Act). The Act amended the Enterprise charter acts and the Federal Housing Enterprises Financial Safety and Soundness Act (Safety and Soundness Act) to establish new requirements for the validation and approval of credit score models by Fannie Mae and Freddie Mac (the Enterprises). FHFA issued a notice of proposed rulemaking on December 20, 2018. The comment period was open for 90 days. FHFA sent the final rule to the Federal Register on August 13, 2019 for publication. The final rule will be effective 60 days from the date it is published in the Federal Register. SUMMARY OF THE PROPOSED RULE • Solicitation of applications from credit score model providers |

HIGHLIGHTS This final rule establishes standards and criteria and outlines a four-phase process by which the Enterprises will validate and approve third-party credit score models. Credit score models will be evaluated for factors such as accuracy, reliability, and integrity, as well as impacts on fair lending and the mortgage industry. The final rule establishes aggressive but reasonable deadlines for the Enterprises to solicit and assess complete applications received. Once a credit score model(s) has been evaluated following the process in the rule and approved for implementation, the industry will be given time to implement the new credit score model. |

|

Solicitation of Applications from Credit Score Model Developers

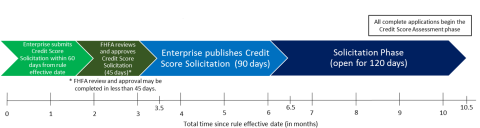

During this phase each Enterprise will publish a “credit score solicitation.” The solicitation will include dates for the solicitation period, a description of the information that must be submitted with the application, a description of the Enterprise process for obtaining data for testing, a description of the Enterprise’s process and criteria for conducting the validation and approval, and any additional information required by the Enterprise, subject to FHFA review and approval. Each Enterprise is required to submit its initial credit score solicitation to FHFA within 60 days of the effective date of the final rule. FHFA will review and approve each Enterprise’s solicitation within 45 days. The Enterprise will then publish its solicitation for at least 90 days prior to the start of the solicitation period (a future date determined by FHFA). This is to ensure that applicants have sufficient time to understand the Enterprise application requirements and validation and approval process prior to submitting their applications. Finally, the initial solicitation period for application submission will be open for 120 days. Figure 1: Illustration of Initial Solicitation Maximum Timeframe Image

|

Submission and Initial Review of Applications

The final rule will require the Enterprises to determine whether each application submitted is complete and includes all required fees. Each applicant will be required to submit an application fee, fair lending certification, information to demonstrate that its model has been used in making credit decisions, information about the qualifications of the credit score model developer, and any other information required by an Enterprise. The Enterprise will also obtain from a third party any data necessary for testing. Applicants will be responsible for the cost of obtaining the data, and an application will not be complete until the third-party data has been received.

Credit Score Assessment

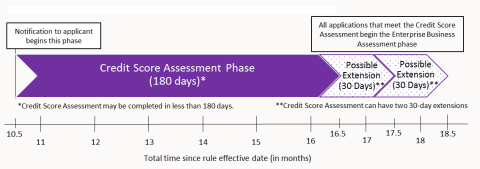

This phase assesses each credit score for accuracy, reliability, and integrity outside of the Enterprise’s business systems. This phase must be completed within 180 days, with two possible FHFA-approved 30-day extensions.

The final rule requires the Enterprises to establish an accuracy benchmark for the initial credit score assessment. For future credit score assessments, the Enterprise will evaluate accuracy based on whether the applicant’s model is more accurate than any validated and approved credit score model required by the Enterprises at that time.

Figure 2: Illustration of Initial Credit Score Assessment Maximum Timeframe

Enterprise Business Assessment

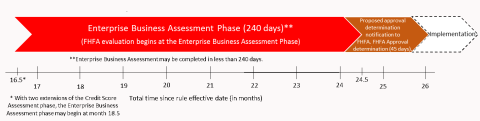

All applications that pass the credit score assessment begin the Enterprise business assessment phase – the final phase of the process. This phase assesses each credit score model in conjunction with the Enterprises' business systems that condition the purchase of a mortgage loan on a borrower’s credit score. The Enterprise business assessment would evaluate accuracy and reliability within the Enterprise systems, impacts on fair lending, possible competitive effects from using a particular model, an assessment of the model provider as a potential vendor, the impact to the mortgage finance industry, and the impact on the Enterprises' operations and risk management. This phase must be completed within 240 days.

FHFA will conduct an independent analysis of the potential impacts of any change to an Enterprise’s credit score model at the same time that the Enterprises are conducting their Enterprise Business Assessment. The final rule permits FHFA to establish requirements for the Enterprises related to their use of credit score models based on the results of FHFA’s analysis.

An Enterprise must submit any proposed determination on a credit score model to FHFA for review and approval. If an application is approved, the credit score model will be implemented by the Enterprise in its systems. Any approval of a new credit score model will be publicly announced.

Figure 3: Illustration of Initial Enterprise Business Assessment Maximum Timeframe

Timeframes and Implementation

The final rule does not address the timeframe for industry adoption and implementation of a new credit score model(s). These timeframes will be in addition to the timeframe for the entire validation and approval process. FHFA and the Enterprises will work with the industry on implementation once the Enterprises have a new validated and approved credit score model(s). FHFA believes, based on years of related credit score work, that it will take the industry approximately 18-24 months to adopt a new credit score model after a model has been approved by an Enterprise.

Attachments:

Validation and Approval of Credit Score Models Final Rule

Contacts:

Media: Stefanie Johnson (202) 649-3030 / Corinne Russell (202) 649-3032