| BACKGROUND

The Federal Housing Finance Agency (FHFA) requires sales of non- performing loans (NPLs) and re-performing loans (RPLs) by Freddie Mac and Fannie Mae (the Enterprises) to meet specific requirements. Drawing on the Enterprises’ experience with NPL and RPL sales, FHFA continues to enhance the NPL and RPL sales requirements, including enhanced requirements announced in 2021 to provide borrower protections under the Coronavirus Aid, Relief, and Economic Security Act of 2020 (CARES Act). FHFA has further enhanced the RPL sales requirements to include a new “payment deferral” option in the loss mitigation waterfall that servicers must apply to RPLs.

FHFA’s goal is to achieve more favorable outcomes for borrowers and communities by providing alternatives to foreclosure wherever possible. Reporting on borrower outcomes is required for servicers of loans sold as NPLs and RPLs. For NPLs, FHFA periodically publishes the Enterprise Non-Performing Loan Sales Report and posts the report to the FHFA public website.

NPL AND RPL SALE REQUIREMENTS

FHFA and the Enterprises have established requirements to protect borrowers with loans sold as NPLs or RPLs.

- Bidder qualifications: Bidders are required to identify their servicing partners at the time of qualification and must complete a servicing questionnaire to demonstrate a record of successful resolution of loans through alternatives to foreclosure.

- Loss mitigation waterfall requirements: Servicers must apply a waterfall of resolution tactics that first includes evaluating borrower eligibility for a loan modification (for NPLs and RPLs) and payment deferral (for RPLs), then a short sale or a deed-in-lieu of foreclosure. Foreclosure must be the last option in the waterfall.

|

KEY ELEMENTS OF NPL AND RPL SALE GUIDELINES

Servicers must apply a waterfall of resolution tactics that first includes evaluating borrower eligibility for a loan modification, then a short sale or a deed-in-lieu of foreclosure.

Modifications must provide a benefit to the borrower and the potential to be sustainable, and may include principal and/or arrearage forgiveness. Foreclosure must be the last option in the waterfall.

Loans that are under a forbearance plan, or that were under a forbearance plan within the past 90 days, are not eligible to be included in NPL or RPL sales.

Servicers are encouraged to sell properties that have gone through foreclosure and entered Real Estate Owned (REO) status to buyers who will occupy the property as their primary residence or to nonprofits.

Buyers must agree they will not “walk away” from vacant properties or enter into “contract for deed” agreements on REO properties unless the purchaser is a nonprofit.

NPL buyers and servicers, including subsequent servicers, are required to report loan resolution results and borrower outcomes to the Enterprises for four years after the NPL sale.

RPL buyers and servicers, including subsequent servicers, are required to provide loan level reporting to the Enterprises for four years after the RPL sale.

|

- Modification and Payment Deferral Requirements:

- RPL buyers’ servicers are first required to evaluate borrowers who are able to resolve a financial hardship for loss mitigation that keeps the same monthly mortgage payment by moving past-due principal and interest to the end of the loan as a non-interest-bearing balance (“payment deferral”), due and payable at maturity, sale, refinance, or payoff.

- NPL and RPL buyers’ servicers also are required to solicit and evaluate all borrowers (other than those with an imminent foreclosure sale date or vacant property) for a loan modification that provides a benefit to the borrower and has the potential to be sustained by the borrower over the life of the modification.

- NPL and RPL buyers’ servicers are required to solicit and evaluate borrowers with a mark-to-market loan-to-value ratio above 115 percent for loan modifications that include principal and/or arrearage forgiveness.

- Modifications must not include an upfront fee or require prepayment of any amount of mortgage debt. They must either be fixed rate for the term of the modification or offer an initial period of reduced payments with limits on subsequent increases. The initial period must last for at least 5 years, and interest rate increases may not exceed 1 percentage point per year thereafter.

- No “walkaways”: If a property securing a loan is vacant, buyers and servicers may not abandon the lien and “walk away” from the property. Instead, if a foreclosure alternative is not possible, the servicer must complete a foreclosure or sell or donate the loan, including to a government or nonprofit entity.

- REO sale requirements: Servicers are encouraged to sell properties that have gone through foreclosure and entered Real Estate Owned (REO) status to buyers who will occupy the property as their primary residence or to nonprofits. FHFA extended from 20 to 30 days the marketing period where the property may be sold only to buyers who will occupy the property as their primary residence or to nonprofits.

- Restriction on “contract for deed:” NPL and RPL buyers must agree that they will not enter, or allow servicers to enter, contract for deed or lease to own agreements on REO properties unless the tenant or purchaser is a nonprofit organization.

- Subsequent servicer requirements: Subsequent servicers must assume all responsibilities of the initial servicer.

- Bidding transparency: To facilitate transparency of the NPL and RPL sales program and encourage robust participation by all interested participants, each Enterprise has developed a process for announcing upcoming sale offerings. This includes webpages on the Enterprise’s website, email distribution to small, nonprofit, and minority- and women-owned business (MWOB) investors, and proactive outreach to potential bidders.

- Small pools: The Enterprises may offer small, geographically concentrated pools of NPLs, where feasible, to maximize opportunities for nonprofit organizations and MWOBs to purchase NPLs. The Enterprises will actively market such offerings to nonprofits and MWOBs and provide additional time for buyers to complete the transaction.

- Reporting Requirements:

- NPL buyers’ servicers, including subsequent servicers, are required to report loan resolution results and borrower outcomes to the Enterprises for four years after the NPL sale. These reports will help FHFA and the public evaluate the NPL program results and determine whether an NPL buyer and NPL servicer continue to be eligible for future sales based on pool level borrower outcomes, adjusted for subsequent market events. FHFA and/or the Enterprises provide public reports on aggregate borrower outcomes at the pool level.

- RPL buyers’ servicers must provide loan level reporting to the Enterprises for four years following the RPL settlement sale.

REPORTING SPOTLIGHT

FHFA may periodically provide performance and outcomes reporting to highlight specific areas of Enterprise NPL and RPL sales programs. Recently, FHFA and the Enterprises evaluated potential concerns about the outcomes of NPL and RPL pools acquired by large/institutional investors. For this evaluation, the Enterprises conducted two analyses:

- NPL Sales: Table 11 of the NPL Sales Report shows the initial disposition of foreclosed properties. Out of approximately 63,000 foreclosed properties as of June 2022:

- 36% were purchased by owner occupant buyers or non-profits.

- 31% were purchased by Investors and/or Unknown buyers (see chart below).

- 20% were third party sales (i.e., auctioned on the courthouse steps after foreclosure), and the ultimate buyer is not tracked in the NPL reporting.

- 6% were in the REO process.

- 6% were held for rental (3,992 properties).

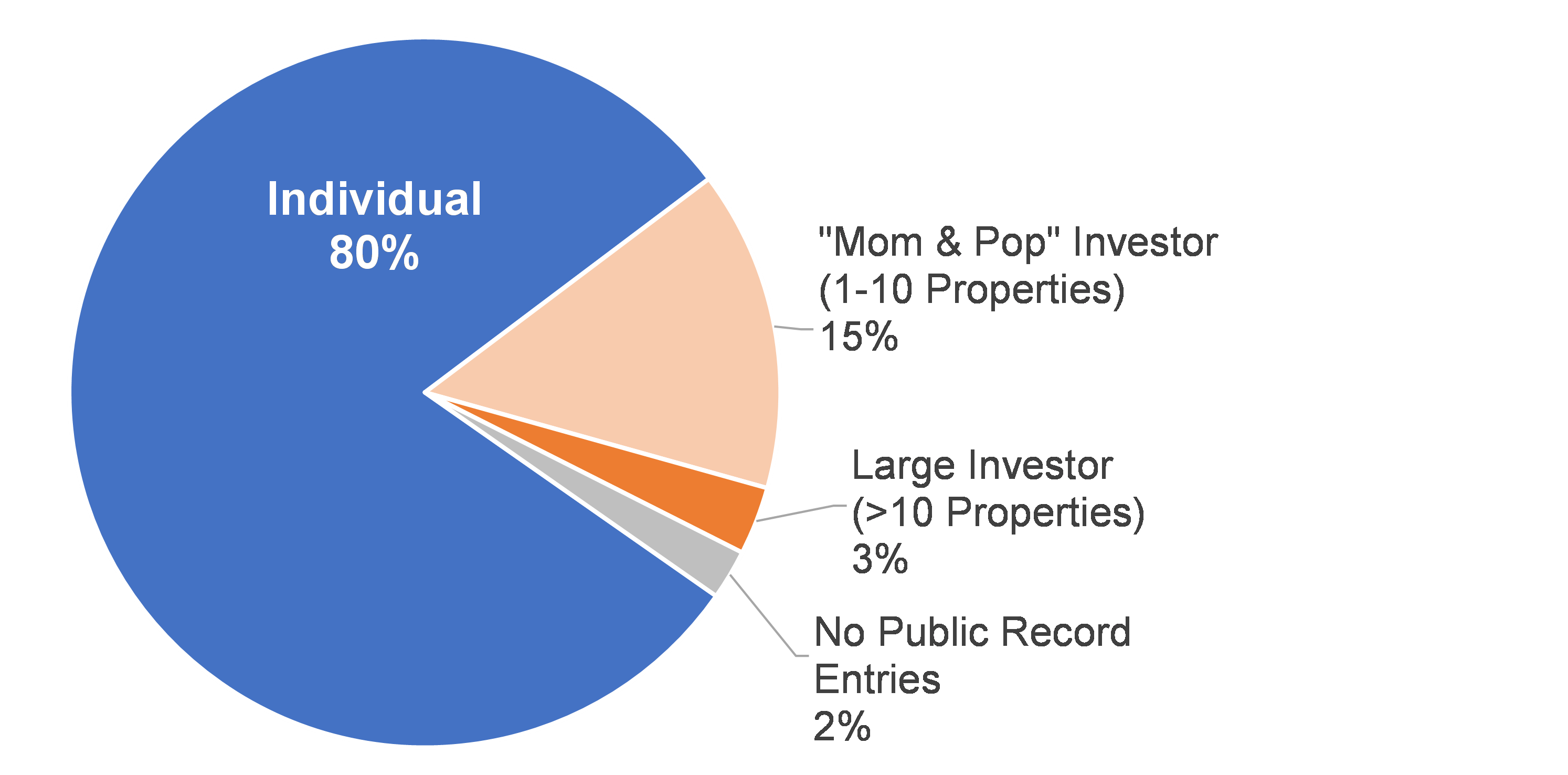

To better understand the size of investors and investor strategies involved in purchasing foreclosed properties, the Enterprises contracted with an external vendor to complete a public records search to determine the current owner type (e.g., individual, small investor, etc.) of the approximately 20,000 properties sold to “Unknown” and “Investor” buyer types. The chart below illustrates the results.

Actual Ownership of Properties Sold to "Unknown" and "Investor"

This analysis determined that approximately 80 percent of the properties sold to “Investor” or “Unknown” are currently owner-occupied homes. Additionally, only 3 percent of the properties are identified as being held by large investors. When combined with the Held for Rental category (foreclosed properties held in portfolio by the original NPL buyers) in Table 11 of NPL Sales Report, approximately 4,600 properties are held by large/institutional investors, representing less than 1 percent of the 574,000 properties estimated to be owned by large investors.1

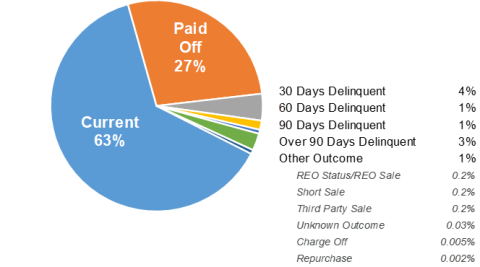

- RPL Sales: To evaluate the outcomes of loans placed in RPL sales, the Enterprises analyzed the securities disclosures associated with RPLs that have been securitized. As of December 31, 2022, approximately 484,600 out of 671,000 RPLs sold (72%) have been placed into securitizations where there is detailed reporting on loan status.2 The following chart summarizes the performance of RPL loans in securitizations:

Loan Status of Securitized RPLs

The chart shows approximately 90% of RPLs are current or paid off, 5% of RPLs are 30 to 60 days delinquent, and 3% of RPLs are 90 or more days delinquent. Most importantly, only 0.6% of RPLs experienced adverse liquidations, and of those liquidations, the Short Sales (0.2%) and Third-Party Sales (0.2%) would have been liquidated through a public sale or auction.

1 - Urban Institute, A Profile of Institutional Investor– Owned Single-Family Rental Properties, April 2023.

2 - The information on RPL outcomes is based on publicly available collateral reports issued by the securitizations’ servicers or trustees. Neither FHFA nor the Enterprises have verified the accuracy of such information.

|