FHFA Announces Proposed Implementation Timelines for Credit Score Models and Credit Report Requirements and a Public Engagement Process

The Federal Housing Finance Agency (FHFA) announced proposed implementation timelines for the use of the FICO 10T and the VantageScore 4.0 credit score models by Fannie Mae and Freddie Mac (the Enterprises) and for the Enterprises’ requirement to transition to two, rather than three, credit reports from the national consumer reporting agencies. FHFA also announced the beginning of a public engagement process to inform these changes and timelines. These changes are expected to further support accuracy, innovation, and inclusion in credit score models and to reduce costs and encourage innovation in credit report requirements.

The public engagement process will allow stakeholders to provide critical feedback and input on the implementation process and inform further refinement of the proposed implementation plan. FHFA and the Enterprises will work with stakeholders to ensure a smooth transition to the new credit scores and the new credit report requirements in a manner that avoids unnecessary costs and complexity.

Stakeholders can expect:

- A partner playbook with information on timelines, resources, roadmaps, and training opportunities;

- Multiple opportunities to provide feedback, including through a public survey conducted by the Enterprises and targeted outreach to lenders, servicers, investors, mortgage insurers, technology service providers, and other stakeholders;

- Regular meetings to facilitate ongoing communication and updates; and

- Updated resources and training on at least a quarterly basis.

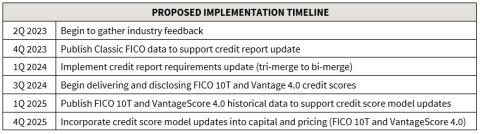

The proposed implementation timeline includes a staged approach to ease the transition complexity for stakeholders. The first stage includes the updates to the credit report requirements (change from tri-merge to bi-merge), and the second stage encompasses the implementation of new credit score models. This process will be informed by ongoing engagement to ensure stakeholders are prepared for the transitions.

View Full Fact Sheet (PDF)

Contacts:

Adam Russell Adam.Russell@FHFA.gov