NSI Pilots – Background

The Neighborhood Stabilization Initiative (NSI) was jointly developed by the Federal Housing Finance Agency (FHFA) and Fannie Mae and Freddie Mac to stabilize neighborhoods that were hardest hit by the housing downturn and reduce the inventory of real estate owned (REO) properties held by Fannie Mae and Freddie Mac. NSI began as a pilot program in the city limits of Detroit, Michigan in May 2014 and was expanded to Cook County, Illinois in April 2015.

Fannie Mae and Freddie Mac will continue to work with the National Community Stabilization Trust (NCST), a national nonprofit organization experienced in stabilization efforts for distressed communities. NCST has ties to community organizations and local nonprofits that have a vested interest in their communities.

NSI Pilots – Lessons Learned

- Critical for success are partnerships with local community buyers and the exclusive opportunity for these buyers to purchase REO properties prior to Fannie Mae and Freddie Mac listing them for retail sale.

- The Enhanced First Look process is an effective tool to responsibly dispose of REO properties and stabilize neighborhoods.

- Expansion of NSI to multiple cities at one time benefits hardest hit communities most quickly and achieves maximum effectiveness vs. city-by-city expansion.

NSI Expansion – Program Elements

Building on the lessons learned from the Detroit and Cook County pilots, Fannie Mae and Freddie Mac will partner with NCST to expand NSI to 18 different metropolitan statistical areas (MSAs) with high volumes of low-value REO inventory. The expanded NSI program is effective beginning December 1, 2015.

NSI expansion focuses on REO properties and capitalizes on the Enhanced First Look principles utilized in Detroit and Cook County. Fannie Mae and Freddie Mac foreclosed properties that have not been listed for public sale on or after December 1, 2015 will be presented to eligible NCST community buyers for purchase review. NCST buyers will have up to 12 business days to express interest in a property and agree on a price before the property is made publicly available for purchase. During this Enhanced First Look period, NCST community buyers evaluate the property and determine whether they wish to purchase the property for sale or rent, or, in some cases, for demolition. Single family structures, including condominiums, town homes, and 2-4 unit properties, are eligible for Enhanced First Look.

The sales price for properties offered during Enhanced First Look will reflect fair market values that take into account savings in marketing, upkeep, utilities, and taxes – all costs Fannie Mae and Freddie Mac would have paid if the property sold during standard REO inventory disposition, rather than through the Enhanced First Look process. Fannie Mae and Freddie Mac may also contribute funds for demolition of certain properties, based on market costs.

NSI Expansion – Key Elements

-

Fannie Mae and Freddie Mac will work with NCST.

-

NCST community buyers have exclusive opportunity to buy foreclosed properties prior to being listed for sale to the public.

-

Properties will be sold at fair market value, which includes discounts for expenses saved through a quicker sale.

-

Expansion will be in 18 selected MSAs simultaneously.

NSI Expansion – Selected Markets

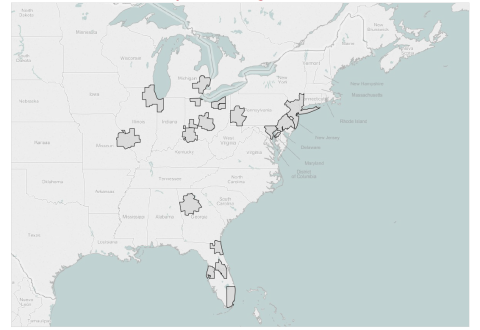

The selection of markets for NSI expansion was based on MSAs where Fannie Mae and Freddie Mac each had at least 100 REO properties valued at less than $75,000. However, once expansion of NSI is in effect, properties in these MSAs valued up to $175,000 will be eligible for the program. Below is an interactive map indicating each of the 18 MSAs included in the NSI expansion.

List of Selected MSAs

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The number of REO properties owned by Fannie Mae and Freddie Mac is declining and approaching pre-crisis levels in some states. At the national level, the REO inventory of Fannie Mae and Freddie Mac has declined from its 3Q10 peak of nearly 250,000 properties to roughly 77,000 as of 3Q15, as dispositions outpace acquisitions. However, in some areas of the country REO inventory continues to increase or remains elevated. Some particular markets have large concentrations of distressed and low-value REO properties.

Given the unique challenges presented by these markets, Fannie Mae and Freddie Mac partnered with NCST to leverage their ties to “boots on the ground” community organizations and local nonprofits, and work closely with local governments to make timely and informed decisions about the best treatment of individual properties.

Attachments:

Contacts:

Media: Corinne Russell (202) 649-3032 / Stefanie Johnson (202) 649-3030

Consumers: Consumer Communications or (202) 649-3811