1/31/2020

1. Why are the Enterprises updating their minimum financial eligibility requirements for Single-Family Seller/Servicers?

- The updated financial requirements further improve Seller/Servicer standards and provide transparency and consistency of the capital and liquidity required for Seller/Servicers with different business models. A critical improvement from the minimum financial requirements established in 2015 is addressing the risk factors related to servicing Ginnie Mae mortgages. The updated requirements improve the safety and soundness of the Enterprises by strengthening Seller/Servicer counterparties in the event of an economic downturn.

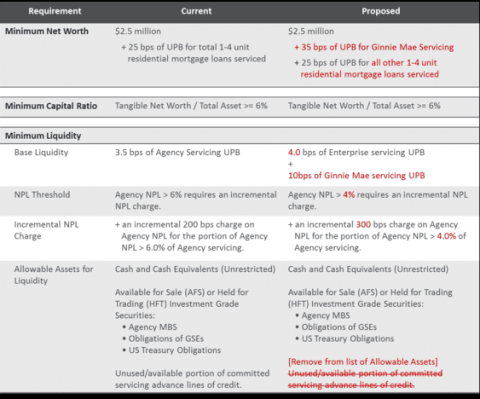

2. What has changed from the minimum financial eligibility requirements issued in 2015?

3. When will the updated minimum financial requirements for Enterprise Seller/Servicers be effective?

- FHFA anticipates finalizing these requirements in the second quarter of 2020 and anticipates that the requirements will be effective six months after they are finalized.

- Enterprise Seller/Servicers must fully comply with all components of the minimum financial requirements by the effective date.

- Seller/Servicers that do not comply with the updated minimum financial requirements as of the effective date may be considered for a transition period, subject to the Enterprises’ discretion.

4. What if a Seller/Servicer is unable to maintain the minimum financial requirements?

- Consistent with current practice, if a Seller/Servicer does not maintain compliance with the minimum financial requirements, the Enterprises will have the discretion to take appropriate action.

- A Seller/Servicer should contact its Enterprise customer account manager to discuss this question further.

5. How frequently will compliance of the minimum financial requirements be tested?

- Seller/Servicer compliance with the minimum financial requirements will be reviewed on a quarterly basis by the Enterprises.

6. Will Seller/Servicers engaged in servicing transfers be required to be in immediate compliance with the new minimum requirements after the effective date?

- Yes. The Enterprises will continue to assess whether both the Transferor and the Transferee Servicer meet the minimum requirements as a result of the transaction in addition to other requirements.

7. Could Seller/Servicers have financial requirements in excess of the new minimum financial requirements?

- Yes, the Enterprises may institute requirements beyond the minimum financial requirements for certain Seller/Servicers due to situations including but not limited to overall complexity, or other evidence of heightened risk embedded in the business model or financial condition.

8. Do these new minimum financial requirements establish a regulatory standard for non-depository Seller/Servicers?

- No. These are new minimum financial requirements for approved non-depository Seller/Servicers to engage in business with the Enterprises. Financial regulatory requirements for non-depository Seller/Servicers are the responsibility of applicable regulators.

9. Are depository institutions tested against the new minimum liquidity standards?

- No. Depository institutions have existing regulatory liquidity requirements that the Enterprises will continue to use in assessing financial eligibility. Therefore, only non-depository institutions will be tested against the new liquidity requirements.

10. Will subserviced loans be included in the subservicer’s minimum financial requirements?

- No. The requirements apply to loans where the Servicer serves as Master Servicer. Loans that are subserviced are not applied to either the capital or liquidity requirement, however a subservicer must be an Enterprise-approved servicer. All Enterprise-approved Servicers must meet the minimum net worth and tangible capital ratio requirements.

11. Is there an exception process to the new minimum financial requirements?

- The Enterprises may review Seller/Servicer requests and make exceptions where warranted.

12. What is the impact of the updated minimum financial requirements on MSR values and Servicers’ willingness to grow their servicing portfolios?

- The Enterprises carefully considered these impacts and believe the requirements are appropriate and provide the right balance between managing counterparty risks and encouraging investments in the servicing business.

13. Is there a differentiation in the minimum liquidity requirement between remittance types?

- No. Presently, there is not a differentiation in the minimum liquidity requirement between scheduled and actual remittance types although the Enterprises will continue to evaluate the requirement on an ongoing basis to determine whether a differentiation should be made.

14. What will happen if Ginnie Mae changes its issuer/servicer liquidity or capital requirements?

- FHFA will work with the Enterprises to reevaluate the Servicer Eligibility component that pertains to Ginnie Mae servicing portfolio, and issue changes where appropriate.

15. What should a Seller/Servicer do if it has additional questions about the proposed minimum financial requirements?

- FHFA and the Enterprises will conduct outreach with industry trade associations, regulators, a representative group of Seller/Servicers, and other stakeholder groups as appropriate. Seller/Servicers should forward any inquiries to its customer account manager at either Enterprise, or send inquiries to ServicerEligibility@fhfa.gov.

Definitions

Enterprises – Fannie Mae and Freddie Mac

Agency servicing – the aggregate UPB (unpaid principal balance) of single-family mortgages serviced for Freddie Mac, Fannie Mae, and Ginnie Mae by the Seller/Servicer

Liquidity – includes the sum of:

a) Cash and Cash Equivalents (Unrestricted)

b) Available for Sale (AFS) or Held for Trading (HFT) Investment Grade Securities:

- Agency MBS

- Obligations of GSEs

- US Treasury Obligations

Non-performing loans – includes loans 90 or more days delinquent and loans in the foreclosure process

Servicing UPB – UPB of single-family residential mortgages serviced by the Seller/Servicer

Tangible Net Worth – total Equity Capital as determined by Generally Accepted Accounting Principles (GAAP), less goodwill and other intangible assets (excluding mortgage servicing rights), and a deduction of “affiliate receivables” and “pledged assets net of associated liabilities”

Contacts:

Media: Raffi Williams (202) 649-3544 / Stefanie Johnson (202) 649-3030