Each calendar year, statute requires FHFA to adjust the conforming loan limits (CLLs) by formula to reflect the national rate of increase in home prices over the past year. More detail on that process can be found in our FAQs.

The CLLs represent the upper limit on the size of mortgages eligible to be acquired by Fannie Mae and Freddie Mac (the Enterprises) and define a conforming loan. Most counties across the country are assigned the national baseline CLL. However, CLLs can be higher in certain high-costs areas when the median house price exceeds 115% of the national median. Above the national baseline CLL, high-cost area CLLs proportionally increase up to a ceiling of 150 percent of the national CLL [1].

This week, FHFA will update CLLs for 2021. In this post, we use FHFA data to look back at 2019 (the most recent complete year) to describe the types of single-family loans and borrowers that were covered by the increase in CLLs from 2018 to 2019. The market impacts of a change in CLLs are complex. The impacts can also vary around the country because local markets vary in terms of home price appreciation and other market conditions, as well as in the composition of homes and borrowers. Patterns in the data showing the loans acquired in 2019 that would not have been eligible in 2018, however, can give a sense of the types of loans that may be acquired in the future due to an expansion of CLLs.

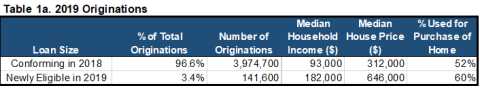

The 2018 national CLL of $453,100 was raised to $484,350 in 2019, and the CLL “ceiling” for high-cost areas increased from $679,650 in 2018 to $726,525. Table 1 presents information on the types of loans potentially impacted by this change. Loans originated in 2019 and acquired by the Enterprises are classified into two categories: (1) those that would have been conforming in 2018; and (2) those who were eligible for acquisition only because the CLLs were raised in 2019.

Key Takeaways:

- Of the more than four million loans originated in 2019 and acquired by the Enterprises, 3.4 percent had loan amounts greater than the 2018 limits. That is, nearly 142,000 borrowers obtained loans larger than the applicable 2018 CLL, but at or below the 2019 limit.

- The typical borrower of mortgages newly eligible in 2019 reported income at origination of $182,000. That represents slightly less than twice the typical income reported by borrowers with Enterprise-acquired mortgages below the applicable 2018 CLL [2].

- Newly eligible loans in 2019 were used to purchase or refinance homes with a median value of $646,000, more than twice the typical home value of other borrowers.

- Although borrowers of newly eligible loans were somewhat more likely to be used for home purchase than for refinancing, those purchasers were more likely to be repeat buyers and not first-time buyers.

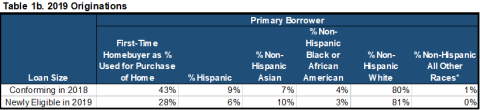

- Primary borrowers of newly eligible mortgages in 2019 were less likely to be Black or Hispanic, and more likely to be Asian or non-Hispanic White, compared to other borrowers [3].

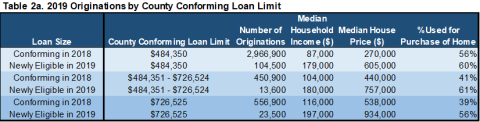

Counties with different CLLs may be different from one another. High cost areas tend to be located on the coasts and may be more urban. In Table 2, statistics are disaggregated by type of county: counties at the national CLL, those with a high-cost CLL but a limit below the ceiling, and those at the CLL ceiling.

Key Takeaways:

- The direction of the differences between newly eligible mortgages in 2019 and mortgages that would have been conforming in 2018 are consistent across the three types of counties.

- In high-cost counties with a CLL at the ceiling (equal to 150 percent of the national CLL), the median home value on newly eligible loans was $934,000.

We have created an interactive map to show the location of newly eligible loans in 2019 by county.

Key Takeaways:

- 52 percent of newly eligible loans were in six states: CA, TX, FL, WA, AZ, and CO. About 38 percent of all Enterprise acquisitions are originated in these locations.

- Although not shown in the map, the top three MSAs for newly eligible loans in 2019 were Los Angeles, Riverside-San Bernardino, and Dallas-Fort Worth. The 10 MSAs with the largest number of newly eligible loans made up 39 percent of all newly eligible loans. Those locations originated 25 percent of all Enterprise acquisitions.

To find CLLs for a particular year, you can find more information on our website. FHFA will release an update to the CLLs for 2021 on November 24, 2020.

[1] A further exception is that Alaska, Hawaii, Guam, and the U.S. Virgin Islands are granted loan limits by statute that, at minimum, are 50 percent above the national limit for the rest of the country. Loans in these locations are classified as being at the CLL ceiling in our tables. Excluding these loans does not materially change the reported statistics.

[2] County by county, we also find that borrowers of newly eligible loans reported income of more than 2.2 times the county-specific household Area Median Income, as compared to 1.2 times for other borrowers. Because borrowers may not report all household income to the lender, the amounts reported most likely represent a lower bound of borrower household income.

[3] We utilize the race/ethnicity of the primary borrower on the loan. Race or ethnicity is not reported for 14 percent of primary borrowers and for this analysis.

Tagged: Conforming Loan Limit; FHFA Stats Blog

By: FHFA Division of Research and Statistics