Introduction

As we noted in our last blogpost about rising home appraisals during the pandemic, the Federal Housing Finance Agency’s (FHFA’s) new Uniform Appraisal Dataset (UAD) Aggregate Statistics Advanced Analytics Dashboard and the underlying data file make single-family home data easier to access and interpret.

In this blogpost, we use a subset of the data to explore how the COVID-19 pandemic has impacted the size of houses purchased. Popular press and initial research suggest a growing preference for more space when working at home. With the UAD Aggregate Statistics Advanced Analytics Dashboard, we determined there was no broad movement toward larger homes; in fact, smaller homes accounted for a slightly larger share of newly purchased homes in 2022 compared to 2013.

Sizes of Appraised Homes

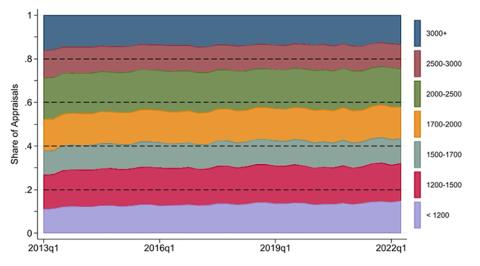

The UAD dashboard and data can answer questions such as: Did homebuyers purchase bigger homes during the pandemic while spending more time living and working in those spaces? Did smaller starter homes vanish as home prices increased dramatically? After manipulating the dashboard’s underlying data, Figure 1 shows the size composition of appraisals for purchases between the first quarter of 2013 and the second quarter of 2022. The size distribution is generally stable during this period, suggesting that buyers did not shift to larger homes in response to the pandemic. The share of purchase appraisals below 1,200 square feet increased slightly from 11.0 percent in the first quarter of 2013 to 14.9 percent in the second quarter of 2022. This finding should be interpreted cautiously, as the data do not necessarily imply that new construction has increased for certain sized homes, since renovations may have taken place for those homes instead. Neither are the data able to capture the entire inventory of existing housing stock.

We also apply some filters to loan or property types – the data do not track appraisals for construction loans, and they exclude manufactured and other types of homes which are present in more rural areas or condos and small multi-unit rental properties that are in present in extremely dense cities. The data reflect appraisals of single-family homes purchased with a conventional and conforming mortgage.

Figure 1: Shares of Appraisals for Purchased Homes by Square Feet, 2013Q1-2022Q2

Where Have Smaller Homes Changed in their Share of Appraisals?

To analyze changes during the pandemic, we compute how much the share of newly purchased homes under 1,200 square feet changed in the second quarter of 2022 compared to the last quarter of 2019. In 75 of the 100 largest Metropolitan Statistical Areas (MSAs), the share of newly purchased homes under 1,200 square feet increased during this time. However, the size of the increase varies substantially among different MSAs.

Table 1 shows where the share of smaller homes is increasing and decreasing the most. Panel (a) lists the MSAs with the largest increases in the share of smaller purchase appraisals. These MSAs are in the lower Midwest and Northeast, while the areas with the largest decreases are mainly in coastal cities. Overall, areas with lower population growth over the past decade tended to have larger movement toward smaller houses during the past two years.

Panel (b) shows MSAs with the largest declines in the share of smaller homes. Unsurprisingly, areas with especially densely populated city centers such as New York, Washington, D.C., and the San Francisco Bay Area are among the areas with the most substantial decreases in the share of appraised smaller homes. This result may suggest that the pandemic caused movement toward larger homes in these markets or may reflect that modern homes (newly built and situated) have shifted toward a different style of attached townhome that is slightly bigger and has neighbors living closer together than single-family detached starter homes from prior decades. Either way, this shift is not seen in the majority of MSAs.

Table 1: Where are the Share of Appraisals for Smaller Homes Increasing and Decreasing?

(a) Top 10 MSAs or the Largest Increase in Share of Appraisals for Single-Family Properties

under 1,200 sq. ft., 2019Q4-2022Q2

| Rank | MSA | Change in Share of Homes <1200 Square Feet |

|---|---|---|

| 1 | Detroit-Dearborn-Livonia, MI* | 4.12 |

| 2 | Warren-Troy-Farmington Hills, MI* | 4.02 |

| 3 | Camden, NJ* | 3.74 |

| 4 | Baltimore-Columbia-Towson, MD | 3.72 |

| 5 | Albany-Schenectady-Troy, NY | 3.69 |

| 6 | Akron, OH | 3.69 |

| 7 | Louisville/Jefferson County, KY-IN | 3.66 |

| 8 | Richmond, VA | 3.42 |

| 9 | Greensboro-High Point, NC | 3.40 |

| 10 | Allentown-Bethlehem-Easton, PA-NJ | 3.37 |

(b) Bottom 10 MSAs or the Largest Increase in Share of Appraisals for Single-Family Properties

under 1,200 sq. ft., 2019Q4-2022Q2

| Rank | MSA | Change in Share of Homes <1200 Square Feet |

|---|---|---|

| 100 | Urban Honolulu, HI | -5.65 |

| 99 | Oxnard-Thousand Oaks-Ventura, CA | -1.95 |

| 98 | San Jose-Sunnyvale-Santa Clara, CA | -1.28 |

| 97 | New York-Jersey City-White Plains, NY-NJ* | -1.14 |

| 96 | Salt Lake City, UT | -1.12 |

| 95 | Worcester, MA-CT | -1.02 |

| 94 | Cambridge-Newton-Framingham, MA* | -0.99 |

| 93 | Washington-Arlington-Alexandria, DC-VA-MD-WV* | -0.98 |

| 92 | Sacramento-Roseville-Folsom, CA | -0.91 |

| 91 | Oakland-Berkeley-Livermore, CA* | -0.74 |

Summary

In conclusion, the UAD Aggregate Statistics Advanced Analytics Dashboard and data suggest that the percentage of smaller home purchases generally increased, with the exception of coastal cities and densely populated city centers. Future research might explore whether this trend reflects regional differences in existing housing stock or a shift in how new homes are being built. As in last week’s blogpost, please note these caveats to the statistics we discussed:

- We only looked at summary statistics without controlling for applicant characteristics.

- The UAD Aggregate Statistics Advanced Analytics Dashboard only includes conventional and conforming loans provided as potential financing for single-family homes. Some property appraisals may not end being used for a mortgage loan. Gaps also occur for other lending market segments as well as purchases made without mortgage financing.

- Urban areas with a large share of condos are not fully represented.

These caveats aside, the UAD Aggregate Statistics Advanced Analytics Dashboard provides an exciting new opportunity to study the value and characteristics of homes being appraised across the country.

Tagged: FHFA Stats Blog; Aggregate Statistics; Appraisals; Data; Data Dashboards; Open Data; Source: FHFA; Uniform Residential Appraisal Report (URAR)

By: Ross Batzer

Economist

Office of Research and Analysis

Division of Research and Statistics

By: Lawrence Costa

Economist

Office of Research and Analysis

Division of Research and Statistics