Prevailing credit profiles in the mortgage market can influence access to housing credit. Among loans securitized by the government-sponsored enterprises (GSEs) Fannie Mae and Freddie Mac, two factors influence such access: the GSEs’ underwriting criteria as implemented through their respective automated underwriting systems and potential additional restrictions or “overlays” that lenders impose. With advancements in the automated underwriting systems and the fact that the GSEs insure the default risk of these mortgages, an important question is, “What is the added value of intermediaries’ discretionary overlays?”

In a recently released working paper, we consider a trade-off in which intermediaries reduce the cost of lending by screening out borrowers who are relatively likely to default but can also charge markups to increase profits. This blog post highlights key findings from the paper.

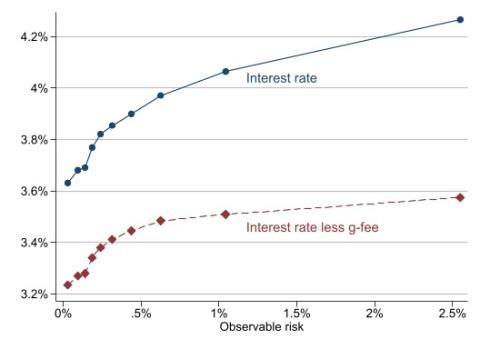

We first show in the paper that, at loan origination, interest rates positively correlate with well-known observable risks, such as lower credit scores, higher loan-to-value (LTV) ratios, and higher debt-to-income (DTI) ratios. This result holds even after we subtract the guarantee fees (or g-fees) that the GSEs charge to insure a loan, suggesting that lenders increase the interest rate to cover their own perceived risks.

Figure 1 illustrates this finding by using a binned scatterplot based on loans originated in 2016 and 2017. The vertical axis corresponds to either the interest rate (blue line) or the interest rate less all g-fees (red line), with upfront g-fees annualized based on a loan’s estimated present value multiplier, similar to the FHFA g-fee report. The horizontal axis depicts the estimated probability of default conditional on a loan’s credit score, LTV, and DTI. On average, a one percentage point increase in observable risk is associated with a nine basis point increase in interest rates net of g-fees.

Figure 1: Interest rates increase with observable risk, even after subtracting the g-fee

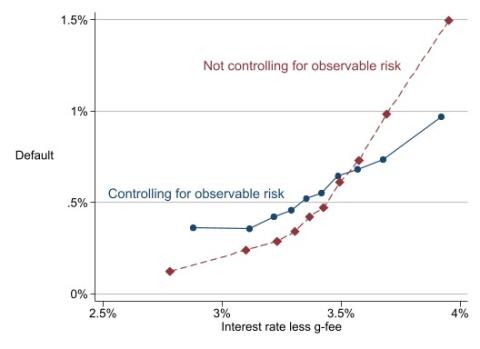

Even for borrowers with comparable observable risk, higher interest rates predict default within two years, as we illustrate in Figure 2. With other evidence from the paper showing that interest rates have a relatively modest direct effect on default, this result suggests that lenders conduct additional screening to determine the risk spread.

Figure 2: Interest rates predict default, even when controlling for observable risk

To explain these figures in the paper, we develop a theoretical model of mortgage lender competition in which lenders face a positive expected loss given default. This liability incentivizes further screening to determine whether to offer a loan and, if so, to better price for risk. The loss given default could correspond to penalties imposed by the GSEs, such as repurchases or restrictions on the ability to continue doing business as a counterparty.

The model shows this additional screening can benefit borrowers with high observable risk relative to a counterfactual scenario in which lenders passively implement the GSEs’ underwriting requirements. However, discretionary behavior by lenders results in higher interest rates for most borrowers.

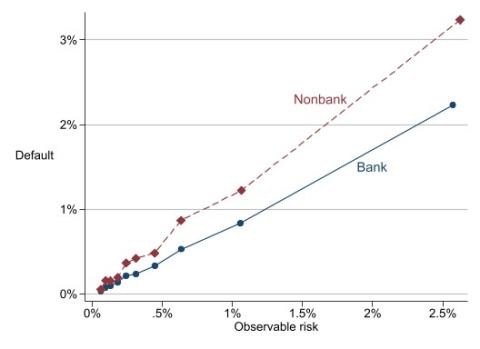

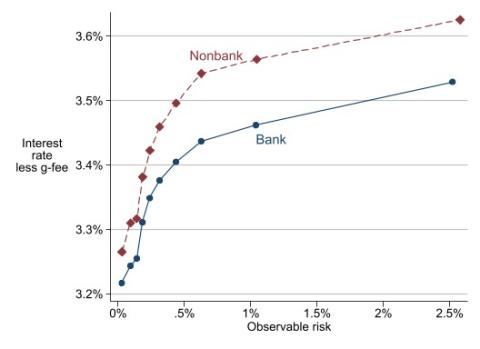

Finally, the model can also explain observed differences between banks and nonbanks. Specifically, nonbanks’ default rates exceed those of banks by more than 50% (0.75% vs. 0.44% for loans originated in 2016 and 2017). The difference partly attributes to nonbanks lending to borrowers with greater observable risk and partly attributes to nonbanks exhibiting higher default rates conditional on observable risk, as we illustrate in Figure 3. Nonbanks are also associated with higher interest rates conditional on observable risk, as we illustrate in Figure 4.

Figure 3: Nonbanks exhibit higher default rates even conditional on observable risk

Figure 4: Nonbanks exhibit higher interest rates even conditional on observable risk

We show in the paper that the observed differences between banks and nonbanks are more consistent with nonbanks having a lower loss given default rather than differences in screening quality. Understanding the nature of nonbanks is important because their share of the market has steadily increased since the financial crisis. Extrapolations from the model indicate that a nonbank-dominated market would have higher default rates but lower interest rates compared to a bank-dominated one.

For additional investigation of these results and further discussion, we invite you to read FHFA Working Paper 23-01 on “The Value of Intermediaries for GSE Loans.”

Tagged: FHFA Stats Blog; GSE; Fannie Mae; Freddie Mac; Government Sponsored Enterprises (GSEs); Guarantee Fees; Guarantee Fees see "G-Fees"; DTI; LTV; Intermediaries; Loan-to-Value (LTV) ratio; Interest Rate; Overlays; Nonbanks

By: Joshua Bosshardt

Federal Housing Finance Agency

Ali Kakhbod

University of California, Berkeley

Amir Kermani

University of California, Berkeley and National Bureau of Economic Research