This blog highlights the unique patterns of securitization of manufactured housing loans within securities issued by Fannie Mae and Freddie Mac. Lenders and investors often favor these loans in “specified pools.” Here we explain the nature and role of specified pools and the characteristics of manufactured housing loans that lead to their inclusion in these pools.

Why Manufactured Housing is Important.

Manufactured homes serve as a source of housing for millions of Americans. They play an important role in providing opportunities for affordable homeownership, especially for consumers with lower incomes and in rural areas. With recent declines in affordability, there has been a renewed interest in manufactured homes as a lower-cost path to homeownership. This is, in part, because construction costs for these homes are much lower than what are typical for site-built homes.[1]

Following enactment of the Housing and Economic Recovery Act of 2008, Fannie Mae and Freddie Mac (the Enterprises) have a statutory “Duty to Serve” three defined underserved markets, one of which is manufactured housing. In 2016, the Federal Housing Finance Agency (FHFA) issued a final regulation codifying the requirements the Enterprises must meet with respect to their Duty to Serve programs, and the first Duty to Serve Underserved Markets Plans took effect in 2018. Since then the Enterprises have implemented actions designed to more fully serve the manufactured housing market.

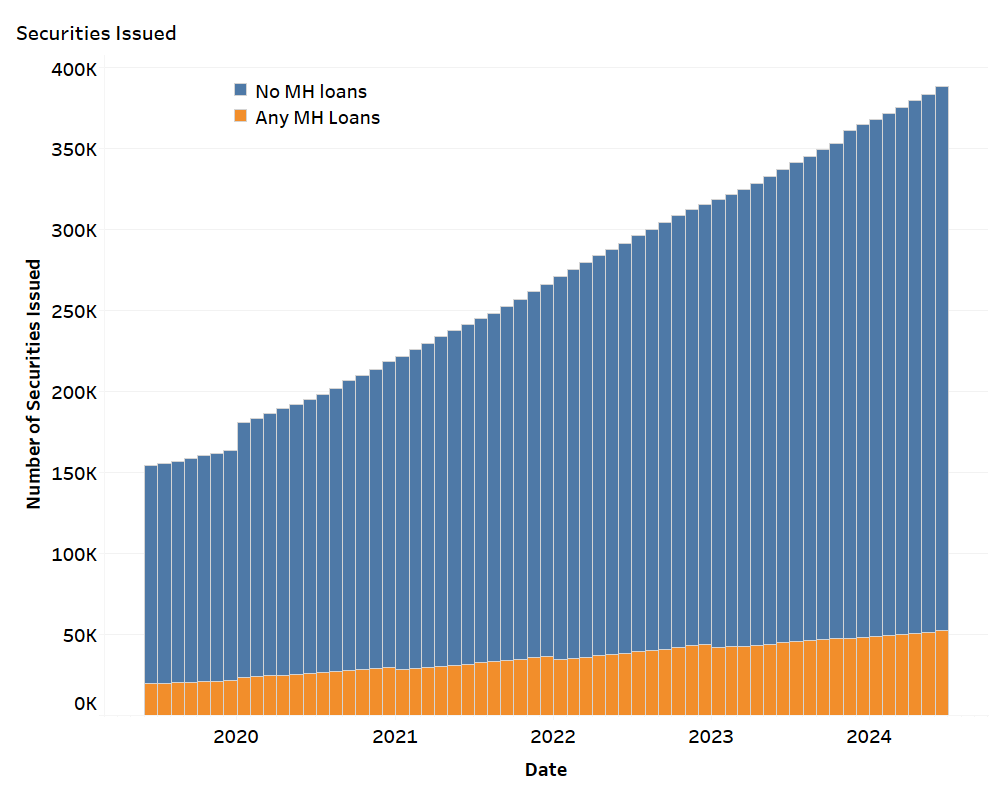

Manufactured housing represents a small portion of single-family loan purchases by the Enterprises,[2] but since mid-2019—when the Enterprises began issuing Uniform Mortgage-Backed Securities (UMBS) and shortly after the commencement of the Duty to Serve program—manufactured housing’s share of Enterprise single-family acquisitions has nearly doubled, rising from 0.43 to 0.80 percent. As shown in Figure 1, manufactured housing loans consistently appear in more than 10 percent of all Enterprise single-family security issuances.

Figure 1: UMBS Securities with and without Manufactured Housing Loans, July 2019 – June 2024 Issuances

Source: Freddie Mac and Fannie Mae MBS Disclosure and Data Reports.[3]

Manufactured Housing Loans and Specified Pools

The way in which manufactured housing loans appear in UMBS is based on how loan pools are constructed. In recent years, specified (“spec”) pools have become an important avenue for attracting investors. Spec pools only include specific types of loans. Each pool has its own requirements, where the unifying theme is that, in general, accepted loans contain features that correlate with slower-than-average prepayments speeds, and which make these loans’ prepayment speeds more consistent with one another.

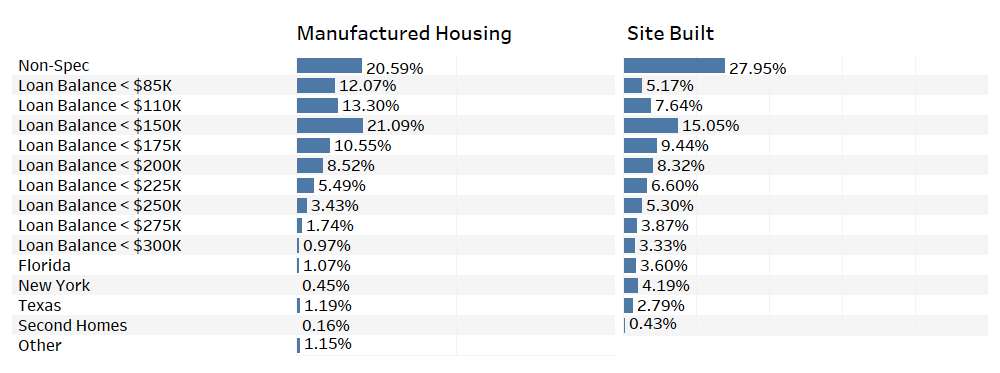

Figure 2 highlights the flow of manufactured housing loans into UMBS, by security type, since the inception of the UMBS program.[4] The center panel of Figure 2 shows that nearly three-fourths of all manufactured housing loans went into spec pools, and principally into low-loan-balance pools.[5] The right side of Figure 2 contrasts that with how non-manufactured home loans (site-built) are distributed across security type. Site built homes are more often in non-spec, higher loan balance, and regional spec pools. Manufactured housing loans also are found spread widely across non-spec pools.[6]

Figure 2: Distribution of Acquired Single-Family Loans into UMBS, by Security Type, July 2019 – June 2024

Source: Freddie Mac and Fannie Mae MBS Disclosure and Data Reports. For historic reasons, the market and the financial press refer to pools restricted to Loan Balance < $85K as “Low Balance Pools,” Loan Balance < $110K as “Medium Balance Pools,” Loan Balance < $150K as “High Balance Pools,” and Loan Balance < $175K as “High High Balance Pools.”

As noted above, spec pools are broadly defined to include loans having similar expected prepayment speeds. Lower prepayment speeds mean UMBS holders are more likely to receive interest payments for an extended time (longer duration), compared with standard, non-specified UMBS. That, however, also makes their value to investors more sensitive to changes in market interest rates.

For manufactured housing loans, lower prepayment rates are related to lower loan balances, which is a primary distinction for many classes of spec pools.[7] Pools that prepay slower than average also include characteristics such as high loan-to-value (LTV) ratios, low borrower credit scores, and investor-owned properties. As seen in Figure 2, additional spec pools are based on property location (e.g., properties located in specific states). The slower prepayment speeds of these geographic spec pools are due mostly to higher closing (transaction) costs of buying and selling homes in these locations.

Investors most value the longer duration that comes from slower prepayment speeds of spec pools when interest rates are falling or when traditional UMBS are trading at a premium over par value (par = unpaid principal balance). In a falling interest rate environment, investor pay-ups from par value can range from one-quarter (25 basis points) to more than 6 percentage points, depending on the type of spec pool.[8]

In rising interest rate environments, those same spec pools become less advantageous, as their longer duration means a greater drop in value. That effect is somewhat reduced by the greater extension (duration) of to-be-announced (TBA) issuances when rates are rising. The net effect is that the difference in prepayment speeds between TBA and spec pools narrows when rates are rising.

Because investors pay a premium for spec pools, the inclusion of manufactured housing loans helps lenders maximize profit. Fundamentally, investors pay for a reduction in uncertainty. They have a better idea of what they are purchasing in spec pools because all loans share some common characteristic(s). That is in contrast with TBA pools, where investors commit in advance to buy securities with some average expected characteristics and interest rates within a defined range.[9]

Shares of Manufactured Housing Loans within UMBS of Various Types

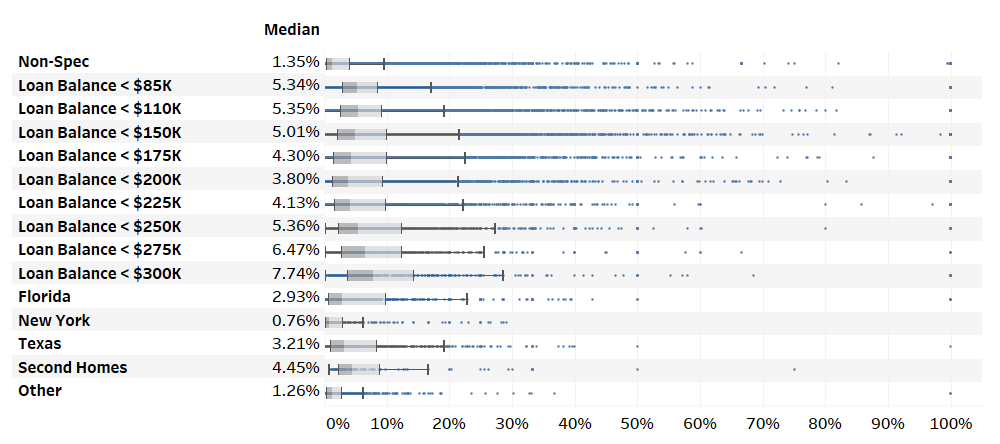

Figure 3 shows shares of manufactured housing loans within UMBS of various types. The “boxes” indicate the middle 50 percent of data points (inter-quartile range). Shading within boxes separates observations in the 25-50 percent range (darker) from those in the 50-75 percent range (lighter).[10] The median share (50th percentile) across securities within each class of UMBS is also identified to the left of the plots. The “whiskers” display data points beyond the boxes.[11]

Most securities, even spec pools, have only a small share of manufactured housing loans, as the boxes are concentrated between zero and 10 percent. In pools having some manufactured housing loans, their share is most often less than 5 percent of all loans.

The data summarized in Figure 3 are consistent with an assignment waterfall: manufactured housing loans first go to spec pools based upon loan balance, and then are spread widely, in non-material amounts, across non-spec pools.

Figure 3: Box and Whiskers Illustration of the Distribution of Manufactured Housing Shares within UMBS, by Security Type, July 2019 to June 2024

Source: Freddie Mac and Fannie Mae MBS Disclosure and Data Reports.

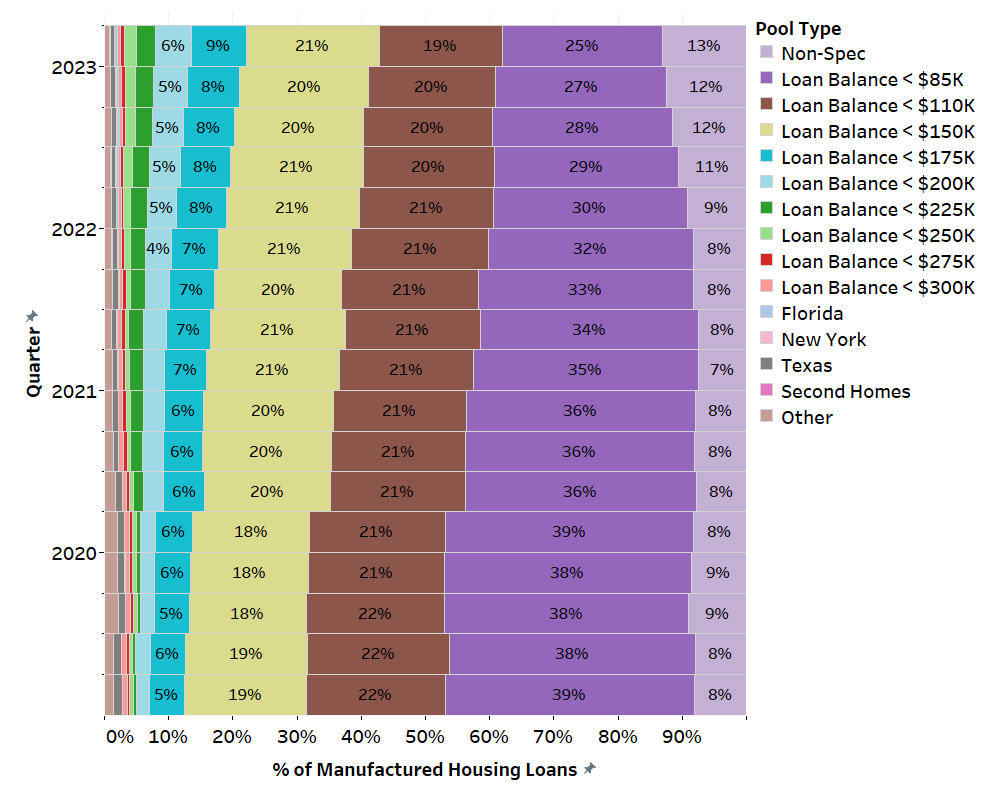

While securities with only manufactured housing loans are regularly issued, they are not common. Of the UMBS issued since 2019 (see Figure 1), only a small share have been composed solely of manufactured housing loans (Figure 4). Among those pools, most would have met the loan balance criteria to be considered spec pools, if lenders had chosen to pool them in such a manner.

Over time, there has been a reduction in numbers of pools focusing on lower loan balances; the count and share of spec pools with balances <$150K are decreasing. The greatest decease is among the <$85K pools, whose monthly issuance counts are less than two thirds of that seen in 2019.

To balance this, Figure 4 shows there has been significant growth in manufactured-only non-spec pools, which need not have limits on loan balances. Issuances of higher-balance manufactured-only spec pools (starting with <$200K) have been rather consistent over time. This indicates that house price inflation affects the manufactured housing sector as it does site-built homes. Note that all loans purchased by the Enterprises are titled as real property, meaning both the land and building are included in the property deed.

Figure 4: Percent of MH Loans in UMBS Pools with only Manufactured Housing Loans, by Pool Type, June 2019 – June 2024

Source: UMBS activity data provided via Freddie Mac and Fannie Mae MBS Data Reports.

[1] 12 U.S.C. § 4565.

[2] Manufactured homes are factory-built, prefabricated dwellings constructed according to the Manufactured Home Construction and Safety Standards administered by the Department of Housing and Urban Development (HUD Code). This differentiates them from “mobile homes,” which were built prior to advent of the HUD Code in 1976, and which have more affinity with recreational vehicles than with permanent homes.

[3] Monthly disclosure data are available from Fannie Mae at, https://fanniemae.mbs-securities.com/fannie/account/datafiles/singleclass/monthly , and from Freddie Mac at https://freddiemac.mbs-securities.com/freddie# . Each requires users to create an account (free of charge) to access data records.

[4] Site built shares do not add to 100% as only the types of pools having MH loans are included.

[5] Loan-balance pools are defined by the maximum allowable loan balance; there are no minimum balance requirements for those securities.

[6] The loan sizes are based upon industry standards, see Markit-Agency-RMBS--Specified-Pool-Summary--December-2017.pdf (ihs.com) second page for definitions.

[7] Nearly all loans going to spec pools are eligible for normal TBA pools. Where they are placed is chosen by the originating lender or loan aggregator.

[8] “Enterprise UMBS Pooling Practices,” FHFA, November 2019.

[9] Unique, pool-specific pricing means spec pools typically trade outside the TBA market and may be marketed to specific investor types having particular diversification needs.

[10] In most of these distributions the lower (2nd) quartile portion is narrower than is the upper (3rd) quartile portion, indicating distributions are right skewed. That makes intuitive sense as the boxes are close to zero yet distributional-shares observations can go to 100 percent.

[11] The whiskers are bounded to create an effective 95-percent coverage interval. That removes observations considered outliers, which could represent data errors.

Arthur Hogan

Division of Research and Statistics

September 2024