Since March, the United States experienced a surge in job losses that has created a concern about the ability of homeowners to pay their mortgages. One way of measuring homeowners’ ability to make their mortgage payments in the current environment is to calculate the incidence of past-due mortgages. Congress passed the CARES Act in March [1], allowing most mortgage borrowers to skip their normal required monthly mortgage payments without harming their consumer credit score or showing their mortgage as past-due in their credit report.[2] [3] Borrowers taking advantage of this provision were also allowed to freeze the past due status of their mortgage at the level it was at when the Act was passed. This meant that most mortgage borrowers who were current when the Act was passed could skip future payments without showing their mortgage as past due in their credit report.

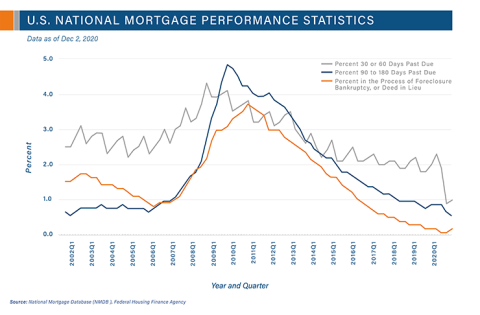

The data presented in the figure below, drawn from the National Mortgage Database (NMDB®) sponsored by FHFA and CFPB, show the national impact of these components of the CARES Act. The data shown are based on what the past-due status of mortgages reported to the credit bureaus would be if a credit report were pulled for every borrower on the last day of the month.[4]

During 2020, mortgages reported to the credit bureaus as having payments 30 or 60 days past due plunged to 1.0 percent as shown in the figure above. The percentages over the past year for mortgages that were 90 to 180 days past due (0.6 percent) and mortgages in the process of foreclosure, bankruptcy, or deed-in-lieu (0.3 percent) remained flat. As a result of these trends, the median credit score of mortgage borrowers, as measured by VantageScore® on borrowers of active mortgage loans, has actually risen slightly in 2020. In contrast, the share of accounts that were reported as more seriously past-due rose sharply in 2009 after the Great Recession and consumer credit scores also suffered.

On the surface, these results might imply that borrowers are having little trouble paying their mortgages. However, because of the changes in reporting due to the CARES Act, this conclusion may be misleading. We estimate that at the end of October 2020 the past due rate would be about 3 percentage points higher if waivers allowed under the CARES Act were not allowed. This would imply a significant increase in the share of mortgages past-due in 2020. The long run implications of these changes may not be known until after the COVID crisis is over. In the interim, it is important to remember that traditional metrics of mortgage performance may not have the same interpretations as they have in the past.

[1] Coronavirus Aid, Relief, and Economic Security Act, Pub. L. No.116-136 (2020).

[2] The CARES Act provides the option for homeowners with federally backed or funded mortgages to request forbearance (a pause) of mortgage payments for up to 180 days. (Pub. L. No.116-136 § 4022(b)). Many borrowers of non-covered mortgages were offered a similar option by their servicers. We estimate that about 6 percent of active borrowers in October 2020 had been granted and were still under a forbearance.

[3] Under normal circumstances borrowers who don’t make their required payments are reported by lenders as “past due” to the credit bureaus. Past due is measured in 30-day increments from 30 to 180 days (180 days past due includes all loans at least 180 days past due but have not gone into the process of foreclosure, bankruptcy or deed in lieu). Any level of past due status is generally harmful to a consumer’s credit report. Being 180 days past due is particularly significant in that lenders typically have the right to foreclose on the borrower at that point.

[4] The mortgage performance data presented here come from the credit reports of borrowers with active mortgages housed in the NMDB, which is maintained by the Federal Housing Finance Agency (FHFA). The NMDB is a representative 1-in-20 sample of closed-end first-lien mortgages reported to Experian, one of the three national credit repositories. It provides performance data on borrowers and their mortgages which look like what you would get if you pulled a credit report on the last day of each quarter for all mortgage borrowers in the United States.

Tagged: FHFA Stats Blog; Mortgage Performance; National Mortgage Database; NMDB

By: FHFA Division of Research and Statistics