Affordable units (those having rents for households in the very low-income range) accounted for over 20 percent of the Enterprises’ financings in 2022, the highest level in over a decade.

Introduction

On September 25, 2023, the Federal Housing Finance Agency (FHFA) released the annual Public Use Databases (PUDB), which disclose information about Fannie Mae and Freddie Mac’s (the Enterprises) 2022 single-family and multifamily mortgage acquisitions.1 In this blog, we use a subset of multifamily mortgage acquisitions data to explore affordable housing and changes over time for very low-income households, defined as being at or below 50 percent of the area median income (AMI).2,3

To support the multifamily market, the Enterprises provided more than $133.5 billion in debt financing in 2022 to help finance over 8,000 mortgage loans for 1.2 million multifamily units.4,5 The Enterprises’ financing accounted for about 40 percent of all multifamily mortgage volume originations in 2022.6

Table 1: Multifamily Mortgages Financed by the Enterprises

| Year | Property Value ($Billions) | Debt Financing ($Billions) | Number of Loans (Thousands) | Number of Units (Thousands) |

|---|---|---|---|---|

| 2022 | 250.4 | 133.5 | 8.0 | 1195.8 |

| 2021 | 225.6 | 130.5 | 8.7 | 1170.5 |

Source: Federal Housing Finance Agency, Enterprise Public Use Database

Both property value and debt financing increased in 2022 as compared to 2021, but the number of properties and the number of loans financed by the Enterprises declined. The average property value increased from $25.9 million to $31.3 million, and the average loan amount increased from $15.0 million to $16.7 million. Despite the decrease in the overall number of properties, the number of multifamily units the Enterprises financed increased by 2.2 percent in 2022.

Below, we first explore the change over time in the number and percentage of affordable housing units (units affordable to households at or below 50 percent AMI). Second, we explore the change over time in the percentage of properties where 100 percent of the units are affordable units, properties where none of the units are affordable units, and mixed-income properties (properties with a combination of affordable and non-affordable units). Finally, we explore the change over time in the percentage of affordable units in small properties (50 or fewer units) and large properties (more than 50 units).7

Affordable Housing Units

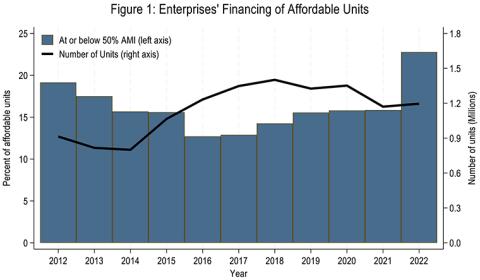

PUDB (specifically, the National File--Unit Class-Level Data) has fields identifying the total number of units and the number of units affordable to very low-income households. Figure 1 below presents the number of affordable units and their percentage relative to the total units the Enterprises financed over the past decade.

In 2022, the Enterprises financed over 270,000 affordable units, an increase from about 185,000 in 2021. The proportion of affordable units as a percentage of total units increased from 15.9 percent to 22.8 percent, the highest share the Enterprises have financed in over a decade.

Source: Federal Housing Finance Agency, Enterprise Public Use Database

Mixed-Income Housing

According to many experts, mixed-income properties promote the socio-economic development of neighborhoods by better integrating racial groups and households across a range of income levels, thereby dispersing pockets of poverty.8 Property owners gain security from affordable units in mixed-income properties because they are eligible for federal subsidy programs (e.g., Low-Income Housing Tax Credits, Section 8 Housing Choice Vouchers, etc.) when renters’ family income is no more than 80 percent of AMI.

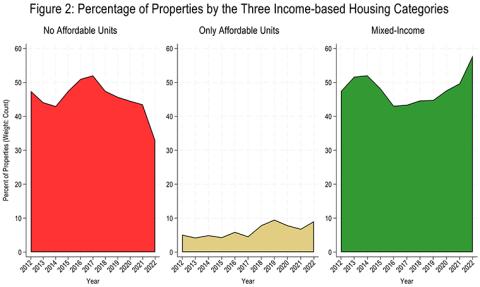

We group the Enterprises’ financings across the United States into the categories of properties with: (i) no affordable units, (ii) only affordable units, and (iii) a combination of affordable and non-affordable units (mixed-income). Figure 2 presents the trends over the past decade for all three categories.

The percentage of Enterprise-financed properties with no affordable units decreased from 43 percent in 2021 to 33 percent in 2022, the lowest level in over a decade.9 The percentage of properties where 100 percent of units are affordable units increased from about 7 percent to 9 percent. But the major increase was for mixed-income properties, which jumped from 50 percent to 58 percent, the highest percentage the Enterprises financed in this category in over a decade.

Source: Federal Housing Finance Agency, Enterprise Public Use Database

Affordable Housing by Property Size

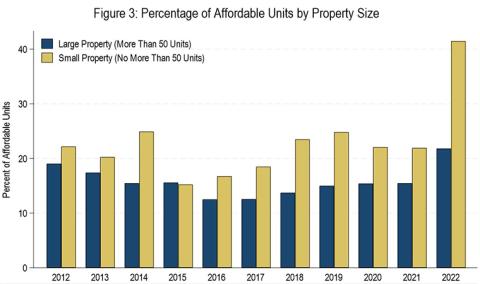

Typically, small multifamily properties are more likely to provide naturally occurring affordable housing based on smaller loan sizes and lower operating costs. However, an increase of affordable units in large multifamily properties also expands affordable housing in various property types (e.g., garden and high-rise apartment complexes) and promotes neighborhood socio-economic integration. Figure 3 below presents the trends over the past decade for the percentage of affordable units for small and large properties.

From 2021 to 2022, the total number of units financed by the Enterprises in small properties decreased from 69,000 to about 58,000, while units in large properties increased from 1.1 million to 1.14 million. Affordable housing units in small properties increased from 15,000 to 24,000, and from 170,000 to 248,000 in large properties. Consequently, the percentage of affordable units in small multifamily properties dramatically increased from 22 percent to 41 percent over the period. But more importantly, the percentage of affordable units in large multifamily properties increased from 15 percent to 22 percent, a 41 percent jump. Again, this is the highest percentage of affordable units (on average) for large multifamily properties that the Enterprises have financed in over a decade.

Source: Federal Housing Finance Agency, Enterprise Public Use Database

Summary

PUDB multifamily data suggests that at the national level, the Enterprises financed a decade-high percentage of affordable units in 2022. Additionally, affordable units were more dispersed than before, with increases in the percentage of affordable units in both mixed-income properties and in those with more than 50 units.

We encourage readers to explore the NMDB Aggregate Statistics on the FHFA website.

1 https://www.fhfa.gov/public-use-database

2 The multifamily data does not contain about $9 billion of properties (6 percent of total Enterprise mortgage acquisitions) that are ineligible for goals credit.

3 Section 3(b)(2) of the Housing Act of 1937 defines low- and very low-income limits and the Department of Housing and Urban Development (HUD) determines them for each metro area annually.

4 To conform with Consumer Financial Protection Bureau (CFPB) Privacy Guidance, FHFA reports acquisition balance of debt financing and property values as the midpoint for the $10,000 interval into which the reported value falls.

5 FHFA estimates the number of units when the affordability level is unavailable, see 12 CFR § 1282.15(e). The affordability level was unavailable for less than 0.5 percent of observations in 2021 and 2022.

6 FHFA bases total multifamily volume origination on data from Home Mortgage Disclosure Act (HMDA) reporting.

7 https://multifamily.fanniemae.com/news-insights/multifamily-market-commentary/differences-identifying-units-small-multifamily

8 https://nhc.org/policy-guide/mixed-income-housing-the-basics/common-incentives-and-offsets-in-mixed-income-housing/

9 This was in part driven by FHFA's focus on mission-driven housing in 2022. FHFA required 50 percent of all multifamily acquisitions be mission-driven and 25 percent be affordable at 60 percent of AMI or below. This, combined with Housing Goals for 2022, drove the Enterprises to engage in more affordable business.

Tagged: FHFA Stats Blog; Source: FHFA; Public Use Database; Enterprises; Affordable Housing

By: Anju Vajja

FHFA Research Officer

Division of Research and Statistics