In 2022, FHFA began collaborating with Fannie Mae and Freddie Mac (the Enterprises) to explore the intersection of

|

The Consumer Protection Working Group:

|

climate change, housing finance, housing policy, and community development. We participated in extensive community engagement and outreach efforts to learn what issues are impacting vulnerable communities across the United States. Hearing from specialists in the field, on-the-ground practitioners, and consumers directly helped us form a comprehensive view of climate risk challenges and opportunities specific to housing finance. Our information gathering made clear that vulnerable populations are disproportionately impacted by climate change, and that housing finance policy should seek to avoid creating or exacerbating unfair burdens in these communities.

Background

Climate risk may have profound impacts on home valuation and household wealth; the costs to heat, cool, and sustain one’s home; and internal migration. Underserved communities are at a distinct disadvantage due to existing wealth and income disparities that limit their ability to adapt, recover, and move. Additionally, historical patterns of resource allocation and infrastructure development have hampered segregated neighborhoods’ ability to be prepared for natural disasters and the impacts of climate change.

Housing policy choices that impact communities differently due to climate change or to the likelihood and severity of natural disasters should be closely assessed to ensure that implementation does not reproduce or intensify existing disparities. This is of special importance to the Enterprises and other national organizations that serve a broad market as part of their mission.

Considerations for Housing Policy Development and Assessment

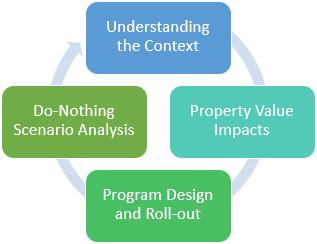

FHFA considers a range of factors and perspectives to inform a holistic policy development and assessment process. A climate assessment framework brings an additional perspective, while complementing longstanding analysis focused on credit risk, capital policy, fair lending, and affordability.

Careful consideration of policy alternatives and identification of opportunities to address existing disproportionate impacts can provide critical openings to redress disparities by ensuring that all consumers have equitable access to sustainable housing opportunities. Well-designed programs can provide new opportunities for consumers to maintain or increase their home’s value, develop resiliency to natural disasters, and improve energy efficiency. These actions can promote and support increased borrower sustainability, leading to stronger safety and soundness outcomes.

We reviewed existing best practices on how to assess projects for climate impacts.i Many of the approaches presented were developed to assess specific, discrete projects or resource allocation questions, rather than more general policy decisions. Leveraging the existing literature in this area, we identify four key dimensions for consideration by policymakers when developing or updating programs and policies.

Understanding the Context

To develop policies and programs that are effective, it is critical to have a clear understanding of context to target

| CONSUMER CLIMATE IMPACT |

|---|

| In this post, we define consumer climate impact as the ways in which natural disasters and climate change impact the ability of homeowners and renters to access safe, sustainable housing opportunities. We define vulnerable populations broadly and expansively to recognize all kinds of vulnerabilities, including racial and ethnic minorities, low-income households, persons with disabilities, and persons aged 62 and older. |

solutions and interventions that respond to the root cause of a problem. For example, an intervention designed to increase resiliency through education may incorrectly assume homeowners do not know about its benefits. While homeowners may be aware that resiliency improvements save money after they are installed, the cost of installation may be too high for low-income homeowners who are already struggling to make their mortgage payments. An examination of the context should also seek to identify available evidence that explains why a specific vulnerable population is more likely to experience adverse effects.

Property Value Impacts

Decision makers should consider the expected change in property values from proposed policies. Policies that base financing decisions according to the flood, wildfire, or other climate-related risk of an area may exacerbate existing inequities. Low-income borrowers and borrowers of color are more likely to live in older homes that may not meet modern building codes or have resiliency features. New policies or programs that discourage living in areas that are at elevated climate-related risk will likely decrease demand for homes in those areas and reduce their values. New policies and programs that increase resiliency to climate-related risk present significant opportunities to reduce disparities.

For example, increases in data transparency and reporting requirements could depress property values in higher risk areas. If lower demand results in lower offers, people living in the area may be unable to afford to relocate to areas with lower risk. Alternatively, programs that help homeowners in formerly redlined communities access financing to harden their home or fortify a roof can increase property values and reduce persistent wealth disparities.

Program Design and Roll-out

The impacts of climate change on building resiliency and energy efficiency are complicated and rife with jargon and other terms that consumers might not easily understand. When designing policies or interventions, special attention should be paid to ensure that communications are transparent and accessible for those most likely to face adverse impacts. Thought should also be given to the need for technical knowledge, the availability of community expertise, and whether upfront costs are involved to determine whether a targeted education or affirmative marketing strategy is needed.

Do-Nothing Scenario Analysis

Similar to environmental assessments undertaken pursuant to the National Environmental Policy Act, it is important to consider the “do-nothing” scenario. In many cases, decision makers are faced with options that may cause harm to a vulnerable population, but attention should also be given to the harm caused by not taking any action. Decision makers should seek to implement policy priorities in ways such that communities do not experience a sudden devaluation shock or a sudden lack of access to liquidity. For example, providing education and incentives before implementing penalties may provide needed time for communities to take action. Consideration should be provided to second- and third-order impacts – both positive and negative – of an action.

Summary

| CLIMATE RISK TO HOUSING FINANCE |

|---|

FHFA’s Strategic Plan for 2022-2026 includes an objective to advance equity in housing finance. In 2021, in response to FHFA’s Request for Input, respondents urged FHFA to review policy decisions for fair lending and equity impacts related to climate change. Today, FHFA has incorporated climate change considerations into its fair lending and equity policy analysis. This analysis contributes to informing the Agency’s view and approach to addressing natural disasters and climate change. We oversaw a similar process within the Enterprises that sought to include the potential impact of climate change into their individual policy development processes. As we continue to grow our understanding of how natural disasters and climate change will impact consumers, FHFA’s Consumer Protection Working Group will work to ensure that decision making reflects these considerations.

i See, for example, Guidance on Considering Environmental Justice During the Development of Regulatory Actions, EPA (May 2015); Equitable and Effective Climate Change Mitigation: Policy Analysis in the City and County of Denver, CO; and Advancing Equity in California Climate Policy: A New Social Contract for Low-Carbon Transition.

Tagged: climate change; Fair Lending; fair housing

By: Leda DeRosa Bloomfield

Branch Chief for Policy and Equity, Office of Fair Lending Oversight

Division of Housing Mission and Goals

By: Sarah Friedman Examination Specialist, Office of Fair Lending Oversight

Division of Housing Mission and Goals