The Federal Housing Finance Agency (FHFA) just extended the deadline for the Home Affordable Refinance Program, or

HARP, to September 30, 2017, but with current rates at historic lows there is still time to act. Refinancing through HARP is a streamlined process, and more than 3.4 million homeowners have already done it, but there are still more than 323,000 homeowners who could save an average of $2,400 per year with a HARP refinance.

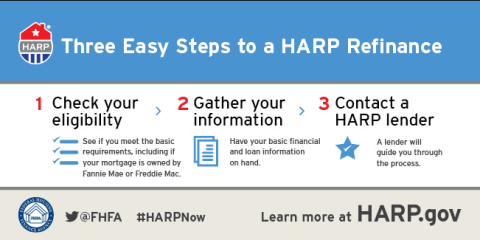

Here are 3 Easy Steps Homeowners Can Take:

- Check eligibility, including whether Freddie Mac or Fannie Mae own their current loan.

- Gather information. Pull together their mortgage statements, tax returns, and bank statements.

- Contact an approved HARP lender. Check here for Freddie Mac or Fannie Mae. Lenders who participate in HARP will walk homeowners through the entire process, all the way through to closing.

Two Ways to Save

There are two ways to save money with HARP: Homeowners can either refinance to a lower interest rate and experience significant savings on their monthly mortgage payment, or refinance to a shorter-term mortgage, which translates to greater savings over the long term and helps build equity faster.

Even if a homeowner has been previously turned down for HARP, he or she may still qualify and can try again. Additionally, homeowners who have previously modified their mortgage through the Home Affordable Modification Program (HAMP) are not disqualified from HARP and should check their eligibility to further reduce their payment.

If you are eligible for HARP, this is a unique opportunity to save on your mortgage. Follow us @FHFA on Twitter, LinkedIn and YouTube for more information or go to www.HARP.gov today to learn more about a HARP refinance.

By: Stefanie Johnson

Public Affairs Officer, Office of Congressional Affairs and Communications