As we observe National Hispanic Heritage Month – a celebration of Americans with ancestors in Spain, Mexico, the Caribbean and Central and South America – we want to highlight how FHFA approaches race and ethnicity subgroup analysis. Latino Americans have historically faced barriers to homeownership, a problem that persists today for some Latino communities. Early land laws and other policies promoted segregation by race and ethnicity, enacted barriers to homeownership, and perpetuated the wealth gap.

Other obstacles Latinos face in the path towards homeownership include a lack of funds for a mortgage deposit. Lower down payments can result in higher interest rates and overall higher mortgage costs, which leaves less money for daily living expenses and savings for the future. Latinos who struggle with Limited English Proficiency (LEP) can also experience challenges to homeownership. Lenders are not required to provide oral translators for LEP individuals. And often, LEP borrowers will use their English-proficient child, who may not be familiar with mortgage lending terms, as a translator. As a result, this can leave the borrower without a full understanding of mortgage terms and conditions. Purchasing a home is a high cost financial transaction that involves a great deal of liability; therefore, it is important that LEP borrowers have the same access and understanding of the homebuying process as non-LEP borrowers.

In May of 2018, FHFA, Fannie Mae, and Freddie Mac launched the Mortgage Translation clearinghouse. This online resource provides a repository of translated documents and tools to help mortgage industry professionals and LEP borrowers navigate the homebuying process. The collection now includes translated documents in Spanish, traditional Chinese, Vietnamese, Korean and Tagalog. The clearinghouse also offers a list of industry resources who can provide oral interpretation services to borrowers at no-cost. Furthermore, in an effort to create consistent terminology and simplify translations for documents, FHFA, in collaboration with the Consumer Financial Protection Bureau, Fannie Mae, and Freddie Mac, established standardized glossaries for each translated language.

Latino American subgroups, as well as Asian American and Pacific Islander subgroups, are often aggregated during data analysis. In some cases, Asian American and Pacific Islanders, and American Indian and Alaska Natives are simply categorized as "other." This is often due to the small sample size. These communities are far from monolithic, representing distinct cultures, immigration patterns, and American experiences. Changing borders and immigration laws and policies have drastically shaped these populations by limiting when and under what circumstances migration and naturalization occurred. Both Latino Americans and Asian Americans have historically faced barriers to homeownership, a problem that continues today for some communities.

Recently, the Office of Fair Lending Oversight within the Division of Housing Mission and Goals and the Division of Research and Statistics collaborated on a data analysis designed to highlight these differences. Specifically, we disaggregated data to the furthest extent possible in order to uncover trends and potential disparities that are often hidden in aggregated numbers.

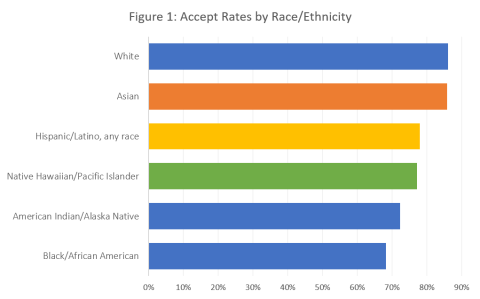

To demonstrate, we conducted analysis using the 2020 Home Mortgage Disclosure Act (HMDA) data published by the Consumer Financial Protection Bureau. Our analysis includes all single-family conventional and conforming loans. Figure 1 illustrates approval rates (for mortgage loans) by race and ethnicity groups.

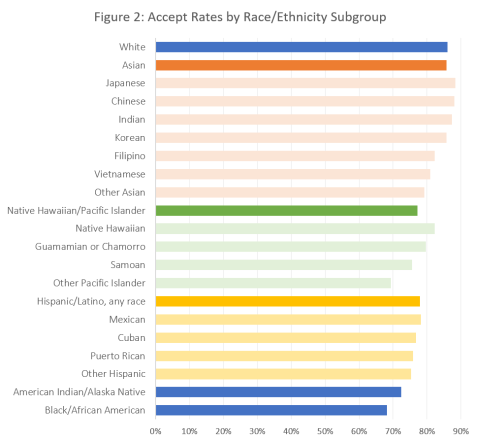

Figure 2 presents the same information with additional subgroup context. Subgroup information provides additional context for analyzing race and ethnicity data and highlights the challenges certain Latino, Asian, and Pacific Islander groups face in accessing mortgage credit. It also underscores the diversity of the American experience.

For Latino communities, we note that Mexican applicants have slightly higher approval rates than Latinos as a whole, but Puerto Rican and "Other Hispanic" applicants have lower approval rates. Among Asian-Americans, the Vietnamese, Filipino and "Other Asian" communities experience lower approval rates than white applicants, despite Asians, as a whole, having similar approval rates as white applicants. Similarly, when the Pacific Islander group is disaggregated, it becomes clear that Samoan and "Other Pacific Islander" applicants have significantly lower approval rates than Native Hawaiian and Chamorro applicants.

Key Takeaways

- When feasible, data should be analyzed at the smallest unit of disaggregation in order to identify barriers, trends, and areas for improvement.

- Failing to disaggregate may result in failure to identify significant disparities facing unique race/ethnicity subgroups for the purpose of identifying barriers and improving housing policy.

FHFA is committed to ensuring equal treatment of all future homeowners regardless of race.

Authors

Leda Bloomfield, Branch Chief, Office of Fair Lending Oversight, Division of Housing Mission and Goals

Denise Lorenzen, Program Analyst, Office of Fair Lending Oversight, Division of Housing Mission and Goals

Ellen Moriarty, Financial Analyst, Office of Policy Evaluation, Division of Research and Statistics

*****

Notes

- All loans are for properties with 1-4 units.

- Applications with the statuses 'Loan originated', 'Application approved but not accepted', 'Purchased loan', and 'Preapproval request approved but not accepted' are 'approved'. Applications with status 'Application denied', and 'Preapproval request denied' are 'denied'. 'Application withdrawn by applicant' and 'File closed for incompleteness' were excluded from the analysis.

- An application is assigned to a race/ethnicity group if any of the races for the borrower or coborrower fell into that category. Categories are not mutually exclusive.

- There were no restrictions on loan purpose (for instance, we did not separate home purchases from refinances).

- For race and ethnicity categories, OFLO uses the following naming conventions:

- White - includes White non-Hispanic applicants or borrowers

- Black/African American

- Hispanic/Latino, any race

- American Indian/Alaskan Native

- Native Hawaiian/Pacific Islander

- Asian

- FHFA includes all write-ins of lender observation of borrower race or ethnicity to identify race or ethnicity in the "other" category. We do not break down the write-ins by race or ethnicity.

Sources

- The Pew Research Center (2017).

- Americans for Financial Reform (2016).

- The Library of Congress, National Archives and Records Administration, National Endowment for the Humanities, National Gallery of Art, National Park Service, Smithsonian Institution and United States Holocaust Memorial Museum. Asian Pacific American Heritage Month website. https://asianpacificheritage.gov. Hispanic Heritage Month website. https://www.hispanicheritagemonth.gov/

- National Asian Pacific American Bar Association. "NAPABA, APABA-SF, and GOAABA Celebrate the Repeal of the Alien Land Law from Florida's Constitution." https://www.apabasfla.org/