One of the most exciting developments in the secondary mortgage market is happening behind the scenes as Fannie

Mae, Freddie Mac (the Enterprises) and key market participants get ready to implement the new Uniform Mortgage-Backed Security (UMBS). The development of and transition to the UMBS, supported by the Common Securitization Platform, make up the Single Security Initiative, part of an important strategic goal FHFA established for the Enterprises to develop a new securitization infrastructure to improve the overall liquidity of their securities. Issuance of the UMBS will mark the culmination of efforts to merge the now separate "To-Be-Announced" markets for the bulk of Fannie Mae and Freddie Mac securities. UMBS issued by the Enterprises are designed to be fungible – that is, mutually interchangeable – trading without regard to which Enterprise is the issuer, in order to broaden and enhance the liquidity of the secondary market on an ongoing basis.

A couple of months ago, FHFA announced the launch date for the UMBS -- June 3, 2019. With just a little over a year to go, stakeholders are actively involved in preparations and monitoring the resolution of the remaining operational and regulatory issues.

Industry preparedness was the focus of a recent conference organized by Fannie Mae and Freddie Mac. Dealers, investors, data providers, index providers and other industry participants packed the event, entitled Single Security 2019: Will You Be Ready? I had the opportunity to attend and came away impressed with the breadth of work underway by key market participants preparing for this milestone event in the U.S. mortgage market. The Timeline on FHFA's website shows the depth of all that has been accomplished, as well as remaining milestones as the launch date approaches.

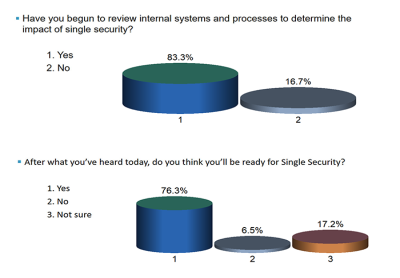

Different industry participants are in varying stages of readiness for the UMBS, but the majority have committed to taking the steps necessary to be ready by the go-live date next year. In response to polling questions at the conference, more than 83 percent of responding attendees said they have work underway to determine the impact of UMBS and more than 76 percent indicated they will be ready for the UMBS. The work is all being done with the principle of launching the UMBS without disruption to the more than $5 trillion Enterprise mortgage market in mind.

Fannie and Freddie executives provided detailed information about their own preparations, what market participants need to be doing now, and the assistance the Enterprises can provide. Industry members described the operational efforts underway and their timelines for meeting the June 2019 date. Data providers shared their development plans and gave market participants a view of some of the changes, such as how their online screens will look upon implementation of the UMBS.

One panel was dedicated to describing the exchange process that current holders of legacy Freddie Mac Gold Participation Certificates can expect when they exchange for the new UMBS. There was also a demonstration of the web application that will facilitate exchange transactions.

Another session described the "end goal" of the Initiative to increase liquidity. FHFA Special Advisor Bob Ryan reiterated FHFA's commitment to an orderly transition to the UMBS, including the agency's monitoring of prepayments which are considered by many as key to ensuring the ongoing fungibility of the UMBS. He also talked of the agency's desire for a smooth transition and the growing confidence that the 2019 launch date will be met.

Everything I heard at the conference points to the momentum that is building in this final year of preparation.

There are many resources available for market participants. If you haven't already, I encourage you to check out the video, Market Adoption Playbook, implementation schedule and other information on the Single Security Initiative pages on the websites of FHFA, Fannie Mae, and Freddie Mac.

As an observer at the conference, it was evident to me that all key players in the market have a role in the success of the Single Security Initiative and in paving a smooth path to the new UMBS. The conference title asks the important question -- Will You Be Ready?

By: Corinne Russell

Principal Public Affairs Specialist, Office of Congressional Affairs and Communications