May is Asian American, Native Hawaiian, and Pacific Islander (AANHPI) Heritage Month – chosen to commemorate the immigration of the first Japanese to the United States in May 1843 and the anniversary of the completion of the transcontinental railroad in May 1869.i

AANHPIs have historically experienced and continue to face barriers to homeownership. In the late nineteenth and early twentieth centuries, many states adopted laws targeted to prevent Asian immigrants from owning a home. These Alien Land Laws were declared unconstitutional only in 1952, and the last one was repealed from a state constitution in 2018.ii

The AANHPI community represents over 30 countries, speaks over 100 languages, and has distinct histories, cultures, and values. They have migrated at different times and under diverse circumstances, impacting their experiences in the United States.

Key Takeaways

-

Data disaggregation provides critical insight into the unique barriers and challenges – as well as successes – of specific communities that may be obfuscated when data is viewed in the aggregate.

-

Applicants and borrowers designating their preferred language on a mortgage application helps provide critical data that can help inform mortgage policy and help market participants develop strategies to better serve their customers.

Data Analysis

FHFA is committed to ensuring equal treatment of all renters and future homeowners regardless of race. As part of our data analysis, we seek to disaggregate data to the greatest extent possible to illuminate trends and potential disparities often hidden in aggregated numbers. Today, many applicants do not wish to provide their race and ethnicity on their mortgage applications. While consumers are not required to provide their race and ethnicity, they are encouraged to do so to help lenders, regulators, and the public identify, measure, and address disparities. Response rates are lower still for the disaggregated categories, with 23% of Asian, 33% of Pacific Islander, and 43% of Latino consumers declining to further specify their race or ethnicity.

FHFA continuously monitors key fair lending indicators to understand where disparities exist and how successful Fannie Mae and Freddie Mac (the Enterprises) are in closing any identified gaps. The analysis below uses 2021 Home Mortgage Disclosure Act (HMDA) data to approximate Enterprise lenders’ mortgage application accept rates.

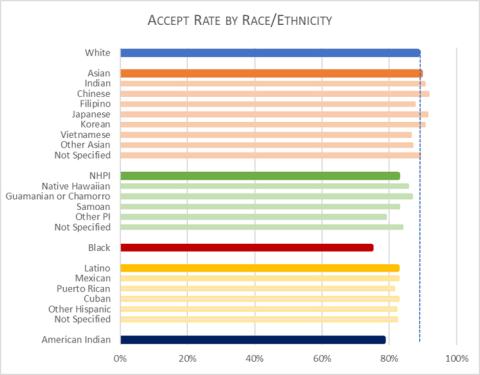

During 2021, Asian applicants had the highest mortgage accept rates of all the primary racial and ethnic groups, and Pacific Islanders had lower accept rates than white and Asian applicants. Subgroup information provides additional context and complexity to the challenges certain Asian groups continue to face in accessing mortgage credit and underscores the diversity of the Asian American experience. In particular, we note that Filipino, Vietnamese, and Other Asian communities experience lower accept rates than white applicants, despite Asians, as a whole, having slightly better accept rates than white applicants. Similarly, when the Pacific Islander group is disaggregated, we note that Samoan and Other Pacific Islander applicants have less access to credit than other groups.

FHFA Actions

While AANHPI families have been part of America’s history for generations, many recent AANHPI and other immigrant applicants may benefit from receiving mortgage information in their preferred language. FHFA and the Enterprises have translated multiple origination and servicing-related documents into Korean, traditional Chinese, Vietnamese, and Tagalog, and these translations are now available on FHFA’s website. Developing or updating a Language Access Plan is a positive step mortgage industry participants can take to effectively and meaningfully communicate with future and current homeowners.

In 2022, FHFA announced that the Enterprises had established requirements for lenders to collect preferred language data and for servicers to obtain, maintain, and transfer this data throughout the mortgage term. When borrowers receive financial information in a language that is most comfortable for them, they are more likely to understand the transaction and their options in case of hardship – thereby promoting mortgage sustainability. Analyzing this data to inform future policy development would be valuable and publishing aggregate data for the public may assist market participants and researchers. FHFA recently issued a Notice of Proposed Rulemaking on Fair Lending Oversight, which would codify the requirements for the Enterprises to collect and report language preference information from the Supplemental Consumer Information Form (SCIF), among other provisions. FHFA encourages the public to submit comments on any aspect of the proposed rule, including language preference data.

Many members of the AANHPI communities live in high-cost areas, which brings additional affordability challenges for many families. FHFA takes great care to craft policies that work for all consumers, regardless of where they live, consistent with the Enterprises’ statutory obligations to promote access to mortgage credit throughout the Nation. For example, the 2023 multifamily volume caps classify loans on affordable units in very cost-burdened renter markets that serve tenants at or below 120% of Area Median Income (AMI) as mission driven. Additionally, FHFA announced in October 2022 that the Enterprises’ upfront fees would be waived for first-time homebuyers with income at or below 100% of AMI. In addition, the income threshold for waiving upfront fees for first-time homebuyers was raised to 120% of AMI in high-cost areas due to the affordability challenges in those areas.iii Further, special statutory provisions establish higher conforming loan limits in several areas, including Guam and Hawaii.

FHFA is also committed to pursuing solutions that better reflect the way consumers interact with the financial system. For example, both Enterprises have worked to incorporate on-time rental payments into their underwriting systems. Many AANHPI families start as renters, and this change helps ensure that these payments are reflected in the Enterprises’ credit assessment.

Through these actions, FHFA and the Enterprises will continue to focus on ways to provide the AANHPI community with access to affordable and sustainable mortgage credit.

Notes

-

FHFA’s fair lending activities include monitoring Fannie Mae, Freddie Mac, and the Federal Home Loan Banks (the regulated entities) for fair housing risk and conducting fair lending examinations on their policies, programs, and activities. FHFA monitors loan application accept rates and trends for fair lending risk and compliance. The data are provided for public transparency and to promote fair lending, but do not by themselves prove or disprove unlawful discrimination.

-

The data include approved and denied applications for conventional conforming first lien home purchase and refinance mortgages for 1-4 unit homes, excluding reverse mortgages.

-

The accept rate represents the proportion of borrowers with complete applications who were approved for a mortgage, including mortgages approved but not originated. An application is assigned to a race/ethnicity group if any of the races for the borrower or coborrower fell into that category. Categories are not mutually exclusive except that white borrowers include only non-Hispanic white applicants who report no other race.

-

For race and ethnicity categories, FHFA uses the following naming conventions:

-

White - includes white, non-Hispanic applicants or borrowers

-

Black/African American

-

Hispanic/Latino, any race

-

American Indian/Alaskan Native

-

Native Hawaiian/Pacific Islander

-

Asian

-

i https://asianpacificheritage.gov/about.html

ii https://www.apabasfla.org/wp-content/uploads/2018/12/PRESS-RELEASE-_-NAPABA-APABA-SF-GOAABA-CELEBRATE-FLORIDA-CONSTITUTION-REPEAL-OF-ALIEN-LAND-LAW-National-Asian-Pacific-American-Bar-Ass1.pdf

iii FHFA is requesting public input on the Enterprises’ single-family pricing framework to solicit feedback on the goals and policy priorities that FHFA should pursue in its oversight of the Enterprises’ pricing framework.

Tagged: Fair Lending; fair housing; Asian American, Native Hawaiian, and Pacific Islander (AANHPI); mortgage accept rate

By: Leda Ka Hee Bloomfield

Branch Chief for Policy and Equity, Office of Fair Lending Oversight, Division of Housing Mission and Goals

By: Scott Susin

Senior Economist, Office of Fair Lending Oversight, Division of Housing Mission and Goals