When we say “housing goals," most people familiar with housing policy think of Fannie Mae and Freddie Mac (the Enterprises). However, the Federal Home Loan Banks (FHLBanks) have housing goals too. FHFA recently issued a proposed rule updating the FHLBank affordable housing goals regulation with the objective of creating a new process with meaningful and achievable targets for the FHLBanks to increase access to affordable mortgage financing.

[Note: Housing goals aim to encourage financing for affordable housing, and they are different from the Affordable Housing Program of the FHLBanks. Yes, we know the names are confusing.]

To better understand the FHLBank housing goals – and to provide background information for FHFA's proposed rule – here's a few key points about the FHLBanks and their mortgage purchase programs:

Voluntary program. Unlike the Enterprises, which are required by their charters to buy mortgages, the FHLBanks buy mortgages through a voluntary program. Because the FHLBanks can opt out of this program, FHFA has considered how to design the housing goals in a way that would not drive them out of the mortgage-buying business.

Image

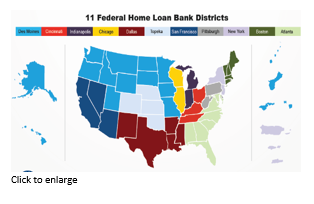

- Eleven separate districts. Each of the FHLBanks serves a distinct geography. Housing goals derived from national mortgage trends or data may not fit individual districts, so the housing goals need to adapt. The proposed rule would create an option for FHLBanks to propose district-specific target levels for FHFA approval.

- Market-takers, not market-makers. The FHLBanks' mortgage purchases represent less than one percent of the secondary market (including Ginnie Mae and the Enterprises). Comparing them retrospectively to market-wide measures – the way goals for the Enterprises work – is not meaningful in the same way.

- Member-owned cooperatives. For many small financial institutions, an FHLBank is often their primary or only access to the secondary mortgage market. FHFA's proposed rule aims to help maintain a focus on small institutions through a small member-participation housing goal.

To see how the differences play out, read the proposed rule. Comments are due January 31.

Tagged: Affordable Housing; Housing Goals; FHLBanks see "Federal Home Loan Banks"; Federal Home Loan Banks; FHFA; Rules; Rulemaking

By: Ethan Handelman

Senior Policy Analyst

Office of Housing and Community Investment