The volume of purchase and refinance FHA appraisals increased between the second quarters of 2023 and 2024 and between the first and second quarters of 2024. The median appraised value for FHA purchase appraisals also increased over the past year and quarter.

The Federal Housing Finance Agency (FHFA) published new appraisal data from loan applications on single-family mortgages insured by the Department of Housing and Urban Development’s (HUD) Federal Housing Administration (FHA) in the Uniform Appraisal Dataset (UAD) Aggregate Statistics Data File and Dashboards on October 28, 2024.[1] The addition of appraisal data from FHA expands the scope of information in FHFA’s UAD, which comprises both annual appraisal-level data as well as aggregate statistics released every quarter. The data previously included only appraisals submitted to Fannie Mae and Freddie Mac (the Enterprises). FHFA is a trusted and leading source of housing finance data, and publishing the UAD Aggregate Statistics provides transparency to the public on trends in residential property valuations. This blog presents key summary statistics on FHA single-family appraisals from the most recent release of the data.

Changes in the Number and Median Value of FHA Single-Family Appraisals in the United States

In 2024Q2, as compared to the year-earlier period, the number of appraisals for FHA single-family loan applications increased 4.3 percent overall, with a 5.9 percent for purchase loans only, and 0.1 percent for refinance loans only (see Table 1). Over the same period, the median appraised value for single-family appraisals increased 3.2 percent for purchase loans and 3.6 percent for refinance loans.

Compared to the previous quarter, the number of FHA single-family appraisals in 2024Q2 increased 16.3 percent overall, with a 19.6 percent increase for purchase loans only, and 7.7 percent for refinance loans only (see Table 1). The quarter-over-quarter increase in single-family appraisal volume for purchase loans is lower than the average increase of 24.5 percent between Q1 and Q2 since 2017.[2] Finally, also compared to the previous quarter, the median appraised value increased 0.4 percent for purchase loans with no change for refinance loans.

Table 1: Changes in Number of FHA Single-Family Appraisals and Median Appraised Value by Loan Purpose

| Loan Purpose for Appraisal | Statistic | 2024Q2 | 2023Q2 | Year-Over-Year Percent Change | 2024Q1 | Quarter-Over-Quarter Percent Change |

|---|---|---|---|---|---|---|

| Purchase or Refinance | Number of Appraisals | 244,549 | 234,366 | 4.3 | 210,233 | 16.3 |

| Purchase | 183,052 | 172,924 | 5.9 | 153,115 | 19.6 | |

| Refinance | 61,497 | 61,442 | 0.1 | 57,118 | 7.7 | |

| Purchase | Median Appraisal Value (Dollars) | 320,000 | 310,000 | 3.2 | 318,600 | 0.4 |

| Refinance | 320,000 | 309,000 | 3.6 | 320,000 | 0.0 |

Source: FHFA. Uniform Appraisal Dataset Aggregate Statistics

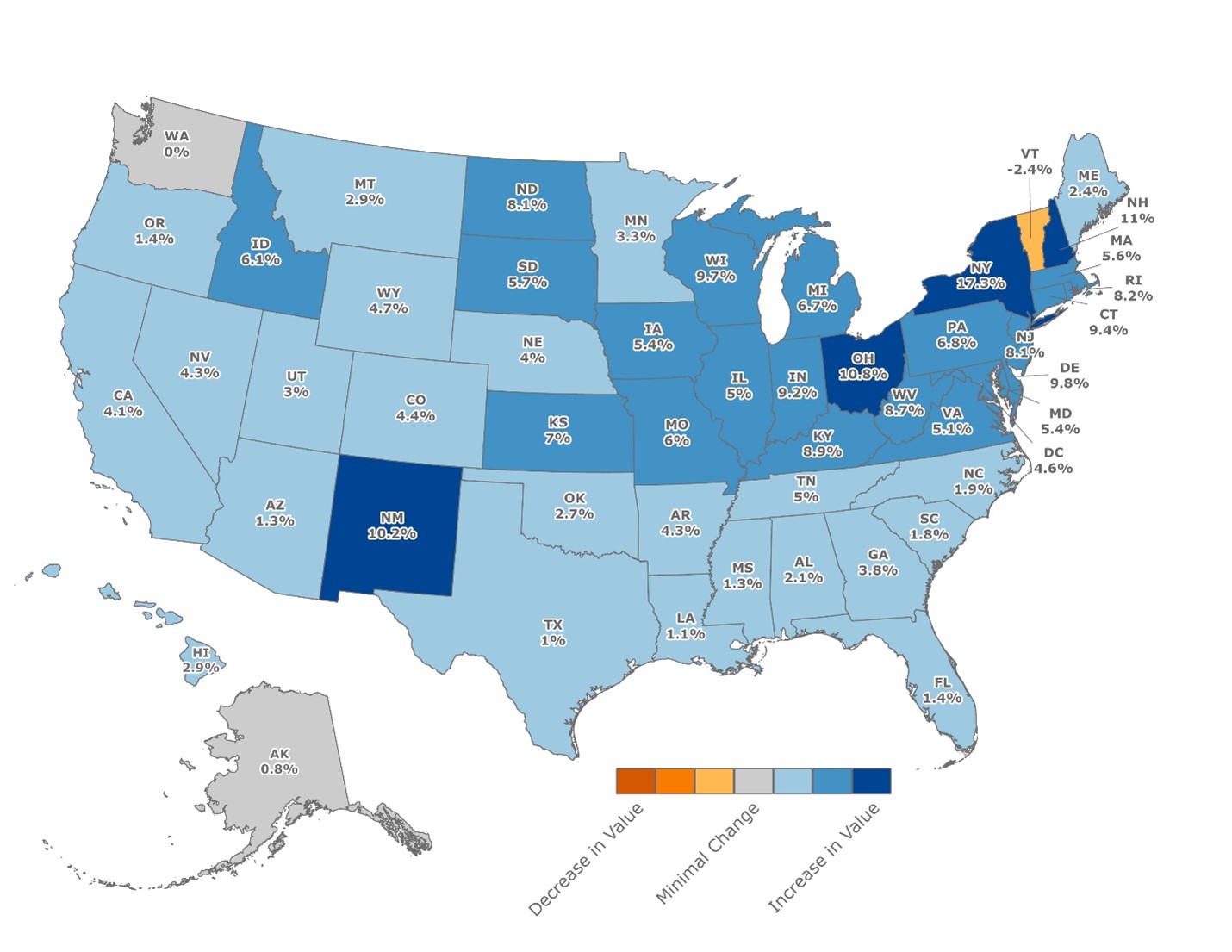

Year-Over-Year Changes in Median Appraised Value for FHA Single-Family Purchase Loans (2023Q2–2024Q2)

Figure 1 shows the year-over-year percent change in median appraised value for purchase appraisals for each state and the District of Columbia. Forty-eight states and the District of Columbia witnessed increases, with the largest gains in New York, New Hampshire, Ohio, and New Mexico. Vermont was the only state to experience a decline, dropping 2.4 percent, with Washington witnessing no change.

Figure 1: Year-Over-Year Changes in Median Appraised Value for FHA Single-Family Purchase Loans, 2023Q2-2024Q2

Source: FHFA. Uniform Appraisal Dataset Aggregate Statistics

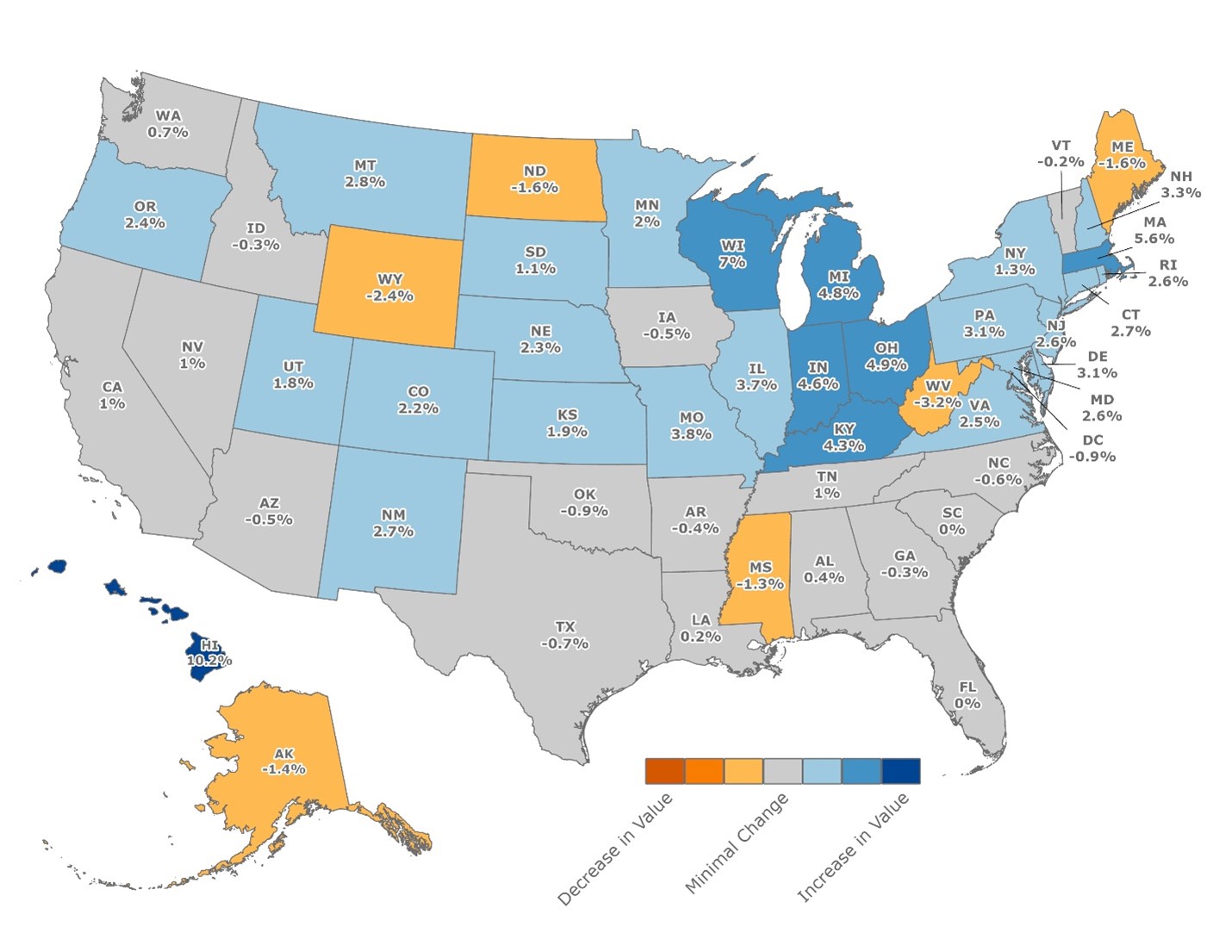

Quarter-Over-Quarter Changes in Median Appraised Value for FHA Single-Family Purchase Loans (2024Q1-2024Q2)

Figure 2 depicts the quarter-over-quarter percent change in median appraised value for single-family purchase appraisals for each state and the District of Columbia. The largest increases were observed in Hawaii, Wisconsin, Massachusetts, Ohio, Michigan, Indiana, and Kentucky; while West Virginia, Wyoming, Maine, North Dakota, Alaska, and Mississippi experienced the largest declines. Twenty-one states plus the District of Columbia experienced less than a 1 percent change over the past quarter.

Figure 2. Quarter-Over-Quarter Changes in Median Appraised Value for FHA Single-Family Purchase Loans

Source: FHFA. Uniform Appraisal Dataset Aggregate Statistics

Summary

The 2024Q2 UAD Aggregate Statistics show that the number of FHA single-family appraisals increased over both the last year and the last quarter. The median appraised value for single-family purchase loans rose over the last year and quarter. Meanwhile, the median appraised value for single-family refinance loans increased over the previous year with no change over the previous quarter.

The largest year-over-year increases in median appraised value for purchase loans took place predominantly in the Northeast, Mid-Atlantic, and Midwest regions. Compared to the previous quarter, the Midwest witnessed the largest increases, with most states in the South and West witnessing weak or negative growth.

The trends reported in this blog could be further explored with the UAD Aggregate Statistics and other FHFA data. The UAD Aggregate Statistics continue to serve as a key resource to glean information on appraisals. For additional FHA and Enterprise aggregate statistics at the national, state, county, census tract, and metropolitan area levels, see the UAD Aggregate Statistics Dashboard Portal. Trends in the Top 100 Metropolitan Statistical Areas are available in the interactive dashboard: https://www.fhfa.gov/data/dashboard/uad-aggregate-statistics-top-100-metro-areas-dashboard.

[1] FHFA derives UAD Aggregate Statistics from aggregating UAD appraisal records. The UAD is a standardized industry dataset for appraisal information that Fannie Mae and Freddie Mac receive electronically through the Uniform Collateral Data Portal© (UCDP©). The UAD Aggregate Statistics data universe is comprised of Enterprise and FHA single-family properties appraised using Fannie Mae Form 1004/Freddie Mac Form 70 and Enterprise condominium appraisals submitted using Fannie Mae Form 1073/Freddie Mac Form 465. We exclude manufactured homes, small multifamily rental properties, and other non-standard appraisals. The universe includes properties appraised for the purposes of a sale or refinance. We exclude other types of appraisals, such as construction loan appraisals. We include appraisals for properties in the 50 U.S. states, the District of Columbia, and Puerto Rico, and exclude the U.S. Virgin Islands and Guam. For more information, please refer to the Data File Overview document.

[2] The average second-quarter percent change in the number of appraisals was calculated by averaging the percent changes between the first and the second quarters each year from 2017 to 2024.

By: Rashida Dorsey-Johnson

Branch Chief, Statistical Products

Office of the Chief Data Officer

Division of Research and Statistics

By: Diego Saltes

Senior Survey Statistician, Statistical Products Branch

Office of the Chief Data Officer

Division of Research and Statistics