Introduction

Property ownership helps families build and maintain generational wealth and is often considered a cornerstone of the American dream. Many families, however, are excluded from fully recognizing these benefits because of an unstable form of property ownership known as heirs’ property. Heirs’ property refers to land or real estate that is inherited without clear title or documentation of ownership. This form of property ownership can cause families to be ineligible for financing or government programs, or lead to challenges retaining the inherited property. This issue can impact anyone, but families from historically underserved communities are most often affected. While little research has explored the national scale of heirs’ property issues, one estimation used 2021 data and identified 444,172 heirs’ parcels in the United States, totaling approximately 9 million acres worth over $41 billion.1

This policy review summarizes research on heirs’ property issues and details efforts being made by Fannie Mae and the Federal Home Loan Banks (FHLBanks).

Background

Heirs’ property ownership can arise when property is passed down through generations (or heirs) without formal wills or other estate planning documents. In such cases, multiple heirs – often siblings, grandchildren, or extended family members – may share an undivided interest in the property without knowing or understanding the ownership structure, including what proportion of the property they own. An undivided interest refers to each family member’s right to access and use the property regardless of their ownership interest in the property. For example, if Person A has a 50% ownership interest in the property, Person A cannot prevent Person B (25%) and Person C (25%) from accessing and using the property. Although there are many reasons a family may prefer to hold joint ownership of land, this unique form of ownership can create a tangled web of legal and financial barriers in cases where there is disagreement over ownership, decision-making, or other matters.2 For example, if all heirs do not agree or cannot be located, it may be impossible to obtain financing for improvements, such as a new roof.

To address the root causes of heirs’ property issues, it is essential to consider the historical context. In the early 20th century, African Americans owned 14 percent of U.S. farmland; that number has since plummeted to 1.3 percent.3 This is partly because many African American families and other historically underserved communities were denied access to formal land records and legal representation. As a result, property ownership often relied on informal arrangements and verbal agreements. Additionally, discriminatory practices – such as racial segregation, restrictive land laws, and unfair and deceptive practices – further exacerbated the problem of land loss in historically underserved communities.

Once the first-generation property owner passed away, discriminatory laws and practices forced many families to sell the land or prevented families from accessing financing, making it challenging for families in underserved communities to retain the property they inherited.4 In addition, without clear title, families may be ineligible for loans from local, state, and federal government programs that would help them maintain the property. Today, historically underserved communities have a disproportionate share of heirs’ property issues due to lack of estate planning resources, distrust of the legal system, and the cost of resolving and clearing property titles.5

A 2023 survey found only about a third of African American and Latino families engaged in estate planning. Without formal estate planning, property may pass to heirs according to a state's intestacy law, leading to the creation of heirs’ property. Greater efforts to provide access to estate planning for affected communities can help prevent heirs’ property issues before they arise.

Impacted Communities and Geographies

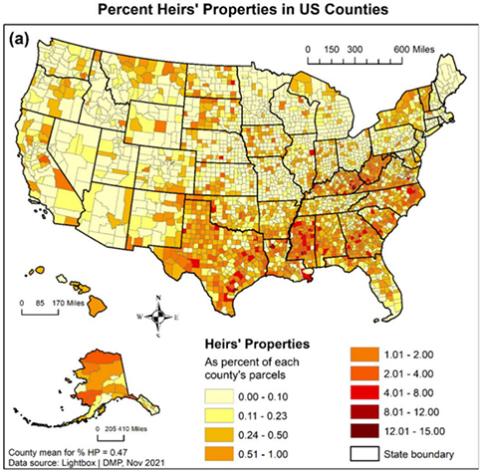

Heirs’ property is an issue often associated with African American farmers in rural communities of the southeastern United States.6 Although African American families are significantly impacted, heirs’ property issues are prevalent among other populations and groups. Heirs’ property is prevalent among Latino populations in the Southwest, Indigenous communities in the West, and White families in Appalachia.7 Similar to African Americans, these groups were affected by discriminatory practices or predatory actions that resulted in significant reductions in land ownership.

Heirs’ property affects homeowners nationwide – in rural, suburban, and urban areas. A 2022 case study conducted in the metropolitan area of Jacksonville, Florida demonstrated that urban heirs’ property shares many characteristics with rural heirs’ property. Heirs’ property tends to be found within lower-income, low housing equity, low educational attainment, and racial and ethnic minority communities.8 Also, a 2021 case study conducted in Philadelphia, Pennsylvania, another metropolitan area, found at least 2% of the city’s residential properties involved tangled titles or heirs’ property.9 The study found that, although demographic data for affected households was unavailable, the neighborhoods most affected tended to be those with relatively low housing values, low incomes, and high poverty rates.10

The Uniform Partition of Heirs Property Act (UPHPA; Act) further demonstrates the national scope of heirs’ property issues. The Act’s purpose is to govern the partition of inherited property to protect heirs from outside parties buying a majority share of the property without the knowledge of the other family members.11 Twenty-three states have enacted the UPHPA into law and eight states have introduced the Act into their current legislative sessions.12

Current Initiatives by the Regulated Entities

Several of the Federal Housing Finance Agency’s (FHFA) regulated entities have developed initiatives to address issues associated with heirs’ property. This section highlights FHLBank and Fannie Mae programs that do so by allocating resources and conducting research to better understand heirs’ property.

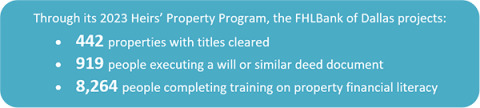

In 2021, the FHLBank of Atlanta held, and the FHLBank of Dallas co-sponsored, the Heirs’ Property Prevention and Resolution Funders’ Forum to raise awareness and allocate funds for innovative actions to address heirs’ property issues. This event provided a venue for organizations to connect and learn about heirs’ property from others working on heirs’ property initiatives. The FHLBank of Atlanta made $1 million in funding available through its Heirs’ Property Prevention and Resolution Grant Initiative to 24 forum participants, including legal services organizations that provide direct assistance establishing legal ownership to heirs. The FHLBank of Dallas, recognizing the prevalence of heirs’ property issues in its district, hearing from its Affordable Housing Advisory Council and Board members, and engaging with the FHLBank of Atlanta, similarly allocated $1 million to its Heirs’ Property Program in 2023. In 2024, the FHLBank of Dallas is doubling its commitment to $2 million.

Fannie Mae’s 2023 Equitable Housing Finance Plan includes actions to address heirs’ property, noting it as a primary contributor to the wealth gap. Fannie Mae conducted research to determine the extent of, and appropriate policy solutions for, heirs’ property issues. In December 2023, Fannie Mae published a research report, in partnership with the Housing Assistance Council, focused on developing new methodologies to identify potential heirs’ property issues on a national scale, since most of the current research is specific to the South and few studies have examined the issue nationally.13 Fannie Mae also explained its goal to “explore title clouds or gaps in heirs’ property, which can preclude sale or financing and oftentimes require extensive legal assistance.”14 A title cloud is anything that impedes the title transfer, such as an encumbrance or heirs’ property. Thus, Fannie Mae is better understanding how heirs’ property can block a title transfer.

Conclusion and Takeaways

Heirs’ property is a significant housing equity issue that continues to impact families and their ability to pass down generational wealth. It remains a persistent and little-known challenge for many families across the country. Rooted in historical injustices and systemic disparities, this issue poses a range of legal, financial, and social challenges. FHFA’s regulated entities have begun to invest resources into understanding, preventing, and resolving heirs’ property issues. These initiatives offer promising results, and future efforts may benefit from increased coordination amongst each other and with other organizations in this space to achieve positive outcomes for homeowners across the country.

By:

Sophie Cooksey

Intern, Office of Fair Lending Oversight

Division of Housing Mission and Goals

Sidney Carter

Policy Analyst, Office of Fair Lending Oversight

Division of Housing Mission and Goals

Sally Tran

Policy Analyst, Office of Housing and Community Investment

Division of Housing Mission and Goals

Note: Special thanks to Natasha Moodie and Lance George at HAC, Zoraima Diaz at Fannie Mae, Pamela Perry at Freddie Mac; Catherine Sterba, Tomeka Strickland, and Reggie O’Shields at FHLBank Atlanta; Gregory Hettrick and Melanie Dill at FHLBank Dallas; and Abigail Suarez, Olivia Barrow Strauss, and Yareqzy Munoz at J.P. Morgan Chase.

References:

1 Dobbs, G. Rebecca, and Cassandra Johnson Gaither. “How Much Heirs’ Property Is There? Using LightBox Data to Estimate Heirs’ Property Extent in the US.” Journal of Rural Social Sciences (2023). Available at: https://srdc.msstate.edu/sites/default/files/2023-06/dobbs_johnson-gaither_pre-print-manuscript-6.5.23.pdf

2 Deaton, B. James. “A review and assessment of the heirs' property issue in the United States. ” Journal of Economic Issues 46, no. 3 (2012): 615-632. Available at: http://www.jstor.org/stable/23264966

3 Id.

4 Hitchner, Sarah, John Schelhas, and Cassandra Johnson Gaither. “‘A privilege and a challenge’: Valuation of heirs’ property by African American landowners and implications for forest management in the Southeastern US.” Small-scale forestry 16 (2017): 395-417.

5 Rothstein, Leah. “Keeping wealth in the family: The role of ‘heirs property’ in eroding Black families’ wealth.” Economic Policy Institute: Working Economics Blog. (2023) Available at: https://www.epi.org/blog/heirs-property/

6 Creech, Archie. “Heirs’ Property: The Legal Issue That Has Cost Black Farmers $326 Billion.” Union of Concerned Scientists: The Equation. (2023) Available at: https://blog.ucsusa.org/archie-creech/heirs-property-the-legal-issue-that-has-cost-black-farmers-326-billion/

7 Deen, Anna. “What is heirs’ property? A huge contributor to Black land loss you might not have heard of.” Grist: Fix Solutions Lab. (2021) Available at: https://grist.org/fix/justice/what-is-heirs-property-a-huge-contributor-to-black-land-loss-you-might-not-have-heard-of/

9 Pew Charitable Trusts. “How ‘Tangled Titles’ Affect Philadelphia: Why Homeowners’ Names Must Appear on Official Records—and How It Hurts Families and Neighborhoods When They Don’t.” Pew Charitable Trusts. (2021) Available at: https://www.pewtrusts.org/en/research-and-analysis/reports/2021/08/how-tangled-titles-affect-philadelphia

10 Id.

11 Uniform Law Commission. “Partition of Heirs Property Act.” (2010) Available at: https://my.uniformlaws.org/committees/community-home?communitykey=50724584-e808-4255-bc5d-8ea4e588371d

12 Id.

13 The Housing Assistance Council. “A Methodological Approach to Estimate Residential Heirs’ Property in the United States.” Fannie Mae. (2023) Available at: https://www.fanniemae.com/sites/g/files/koqyhd191/files/2023-12/heirs-property-research-report_0.pdf

14 Fannie Mae DTS Underserved Markets Plan 2022-2024.

Tagged: Fair Lending; fair housing; Heirs' Property; Intestate